.png)

A Guide to Thriving, Not Just Surviving!

Hey, future young millionaires in the making! As we sprint towards the big 4-0, one key question might be burning in your mind: "How do I set up a killer financial game plan by the time I hit 40?"

Don't sweat it! We've got the secret sauce for you – The 7 Money Milestones® you must achieve and why they're crucial. Plus, some gems from financial educators Lauren Fairey and Christa Mathews can ensure you're not just playing but winning the money game!

The '80 Percent' Retirement Rule

Imagine lounging by the beach, sipping on a piña colada in your golden years. Sounds like a dream, right? You must know the '80 percent' rule to make that a reality. Christa Mathews explains,

“In retirement, you'd ideally want to live on 80% of your current income. So, start planning with that goal in mind.”

Navigating retirement requires foresight, precision, and an in-depth understanding of your financial health. At the heart of this preparation lies a fundamental principle: knowing your numbers. It's not just about how much you save; it's about understanding how those savings translate to your future lifestyle.

Quick math: If you're earning $100,000 now, aim to have enough long-term savings to spend $80,000+ yearly in retirement. Sounds like a lot? Remember, with the magic of compounding and intelligent investing, this dream figure can be within your grasp!

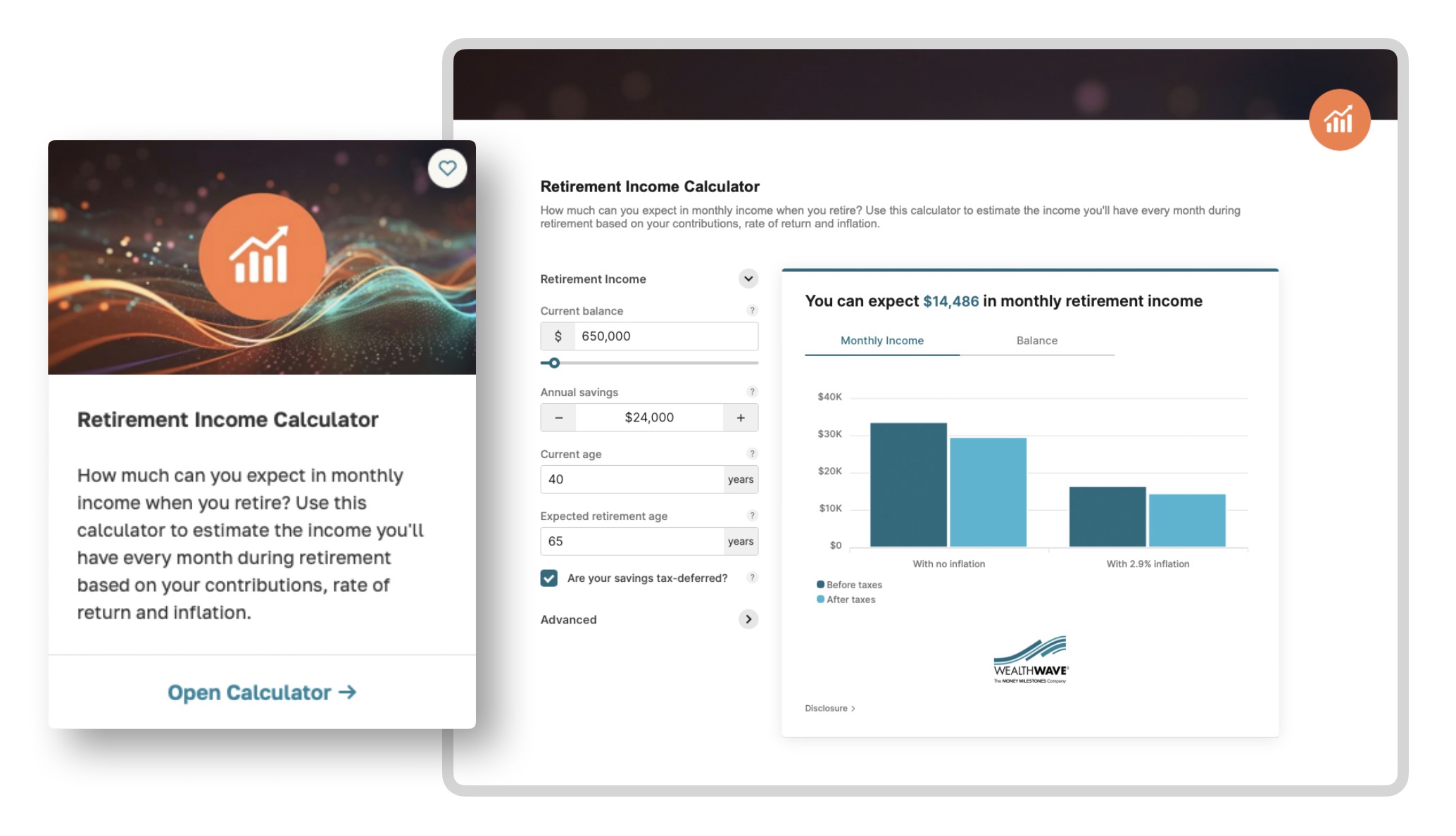

Retirement Income Calculator:

Your gateway to a secure future, a calculator like this, is designed to provide a comprehensive projection of the monthly income you can expect during your golden years. Based on both your current nest egg and anticipated retirement contributions, it can offer a clear picture of your financial horizon. If your aspirations for retirement seem beyond reach with your current trajectory, a financial calculator can serve as an invaluable guide, highlighting areas for potential adjustment.

Should you envision a retirement commencing at 65, this tool becomes essential. Input your present savings, forecasted returns, and monthly contributions, and gain clarity on whether you're genuinely on the path to the retirement you desire. Because, in retirement planning, knowledge isn't just power – it's peace of mind.

Navigating the intricate maze of personal finance can often feel daunting. From managing daily expenses to planning for a future filled with dreams and uncertainties, creating an adaptable and robust roadmap is challenging. A clear path can not only alleviate the overwhelm but can turn financial planning from a chore into an exciting journey of empowerment.

The best-selling TheMoneyBooks series has crystallized this path into seven pivotal money milestones. These milestones are more than just steps; they're transformative shifts that ensure individuals and families survive and thrive in their financial landscapes. As we delve into each milestone, envision them as guiding beacons, illuminating your path to financial mastery and independence.

1. Get a Financial Education

In an age where financial uncertainty looms, arming yourself with knowledge is the first line of defense. Financial education hasn't been a priority in most schools. By diving into one of our TheMoneyBooks, you're giving yourself an invaluable gift: the comprehensive financial education you missed. It serves as a compass, helping navigate the complexities of the monetary world. As the adage goes, knowledge is power – and with these books, you're taking the first vital step to control and optimize your financial destiny.

2. Secure Proper Protection

Life is unpredictable, filled with both exhilarating highs and unforeseen challenges. Securing proper protection through life insurance isn't just a checkbox task; it's a testament to your foresight and care for your loved ones. It ensures that they remain financially shielded against life's curveballs. By investing in life insurance, you're sending a clear message: come what may, the financial well-being of my loved ones is non-negotiable.

3. Create an Emergency Fund

An emergency fund isn't merely a financial buffer; it's the anchor that keeps your financial ship steady during turbulent times. Whether unforeseen medical expenses, sudden job loss, or unexpected repairs, this fund ensures that life's hiccups don't derail your financial journey.

It allows you to face challenges head-on without compromising your long-term financial vision. Your fixed expenses (think mortgage, utilities, groceries) aren't going to pay themselves. Lauren Fairey says,

“Having three months of cash reserve is non-negotiable. It's your safety net against life's curveballs.”

And why three months? Turns out, that's the average time a 40-something needs to score a new gig. As you age, this buffer needs to increase, so by 50, target a six-month reserve.

Your emergency fund is sacred, but life's also for a living! By 40, aim to set aside a cool $5,000 (or more!) for those 'treat yourself' moments. As Lauren says,

“Think of this as the adult version of your childhood piggy bank, but instead of candies, you're splurging on that Parisian getaway or a sleek kitchen makeover.”

4. Apply Debt Management

Debts can be like shackles, holding you back from achieving your financial dreams. However, with strategic debt management, these chains can be broken. It's about understanding, strategizing, and methodically eliminating debt, freeing up resources to fuel your dreams. By managing your debts effectively, you're paving a smoother, more straightforward path to financial prosperity.

5. Increase Cash Flow

Financial growth is not just about saving; it's about expanding your income streams. Actively seeking opportunities to increase your cash flow transforms your financial landscape, opening doors to new investments, opportunities, and financial milestones. With more cash flowing in, you're better positioned to make decisions that align with your present needs and future aspirations.

6. Build Your Wealth

Saving is the beginning; wealth building is the masterstroke. This milestone is all about making your money work for you. Through savvy investing, intelligent financial decisions, and leveraging opportunities, you're not just accumulating wealth but ensuring it can grow, multiply, and create a legacy. It's about transitioning from being a passive saver to an active wealth builder.

7. Protect Your Wealth

Building wealth is commendable, but ensuring it's protected and seamlessly passed on is where true financial mastery lies. Estate planning is the guardian of your financial legacy. It ensures that your hard-earned assets are distributed according to your wishes, safeguarding your loved ones and preserving your financial vision even if you're not around.

These seven milestones offer a holistic blueprint for any individual or family seeking a robust financial future. With these as your guiding principles, the road to financial mastery becomes clear, achievable, and truly empowering. Christa challenges us,

“Planning for your financial future is not about restriction, but about empowering yourself to live fully today and tomorrow!”

So, gear up, take charge, and let's make the journey to 40 and beyond a financially fabulous one!

Setting the Stage for Future Success

Now that we've unlocked the crucial seven money milestones, it's not just about setting these goals but actively working towards them with enthusiasm and determination. Achieving these milestones doesn't happen overnight. It's a marathon, not a sprint, so prepare for a journey full of learning, adapting, and growing. Lauren wisely explains,

“Financial freedom isn't just about accumulating wealth. It's about creating opportunities, having peace of mind, and affording the lifestyle you've always envisioned for yourself and your family.”

Every dollar saved and invested is a step closer to building a financial fortress that allows you to live boldly and confidently.

Furthermore, remember that these milestones aren't set in stone. Life is dynamic, with its fair share of twists and turns. Periodically review and adjust your financial plan to align with your evolving lifestyle, goals, and dreams. As your income grows and your responsibilities change, your approach to money should also mature and develop.

“Your financial plan should be a living, breathing entity that grows and evolves with you. It should be your compass, guiding you through the financial wilderness towards a destination of financial stability and independence,”

advises Christa. Let these milestones be your North Star, illuminating the path towards a stable, secure, and enjoyable life in retirement.

Call to Action

Eager to champion your finances? The ideal time is now! Seize the moment and strategically position yourself for a cascade of financial success. Whether you're a blank canvas just beginning your financial journey or you've already painted a few strokes, let those seven milestones illuminate your pathway. And remember, when you're young, time isn't just on your side — it's your greatest asset. Leverage it!

Don't leave your golden years to chance. Utilize a retirement income calculator to ensure your financial strategy aligns seamlessly with your future aspirations. You can gauge whether you're on track to meet or exceed your retirement dreams by inputting your savings details and anticipated contributions. Planning today brings peace of mind for tomorrow; let the calculator guide you toward a fulfilling retirement.

Engage with financial educators like Lauren and Christa, immerse yourself in financial websites like howmoneyworks.com, and join communities of like-minded individuals navigating their financial journeys. With determination, discipline, and the proper knowledge, the vision of your financially secure future is not just a dream but an achievable reality.

Remember, knowledge is your superpower in personal finance, and action is your ally… especially if you're under 40. So, empower yourself, embrace the challenge, and let's secure a future that's not just financially sound but downright thrilling!

.png)

.png)