.png)

Crafting Your Personal Budget

Imagine two friends, Alex and Jordan, who are in similar financial situations, both earning the same salary from their respective jobs. Despite their similar incomes, their approach to managing their money is vastly different. Alex finds himself living paycheck to paycheck, frequently stressed about his financial situation and often running out of money before the month ends. This constant financial pressure leaves him unable to enjoy his earnings or save for the future.

On the other hand, Jordan seems to lead a more relaxed financial life. He's not only managing to cover his monthly expenses comfortably but is also saving for a dream vacation. The key to Jordan's financial peace of mind? He adheres to a well-structured budget. This budget allows him to allocate his earnings in a way that covers his essential expenses, while also setting aside money for savings and leisure activities. As a result, Jordan experiences less financial stress and has the freedom to plan for future enjoyments, such as his dream vacation, something Alex struggles to imagine for himself.

“A budget is telling your money where to go instead of wondering where it went.”

- John Maxwell

The Importance of Budgeting

Budgeting transcends mere expense tracking; it's a proactive approach to mastering your financial future. A budget is designed to be your roadmap to financial empowerment. By carefully following the steps outlined here, you will learn how to craft a budget that resonates with your lifestyle and financial goals. This isn't about restrictive living; it's about making informed choices that enable you to live more like Jordan, who thrives by making his money work for him, rather than like Alex, who is perpetually trying to catch up with his finances. Through this guide, you'll discover the keys to unlocking a future where your financial dreams are not just possibilities but realities.

Creating Your Budget: A Step-by-Step Guide

- Understand Your Income: Begin by meticulously calculating your monthly take-home pay. This includes all your earnings after taxes and deductions. Knowing your exact income is the foundation for effective budgeting.

- Track Your Spending: Make it a habit to record every single expense, no matter how small. This detailed tracking will illuminate areas where you might be overspending, allowing you to make informed decisions about where to cut back.

- Set Realistic Goals: Establish clear, achievable financial objectives. Whether you're saving for a comfortable retirement, a dream vacation, or an emergency fund, having specific goals provides direction and motivation to stick to your budget.

- Plan for Expenses: Organize your spending into distinct categories such as housing (rent or mortgage), groceries, entertainment, and utilities. This categorization not only simplifies tracking but also helps in allocating funds appropriately, ensuring coverage for all essential needs.

- Adjust as Necessary: Understand that a budget is not immutable. As your life circumstances evolve—be it a career change, a move, or unexpected expenses—so too should your budget. Regularly reviewing and adjusting your budget ensures it remains relevant and effective in meeting your financial goals.

Incorporating Technology: YNAB

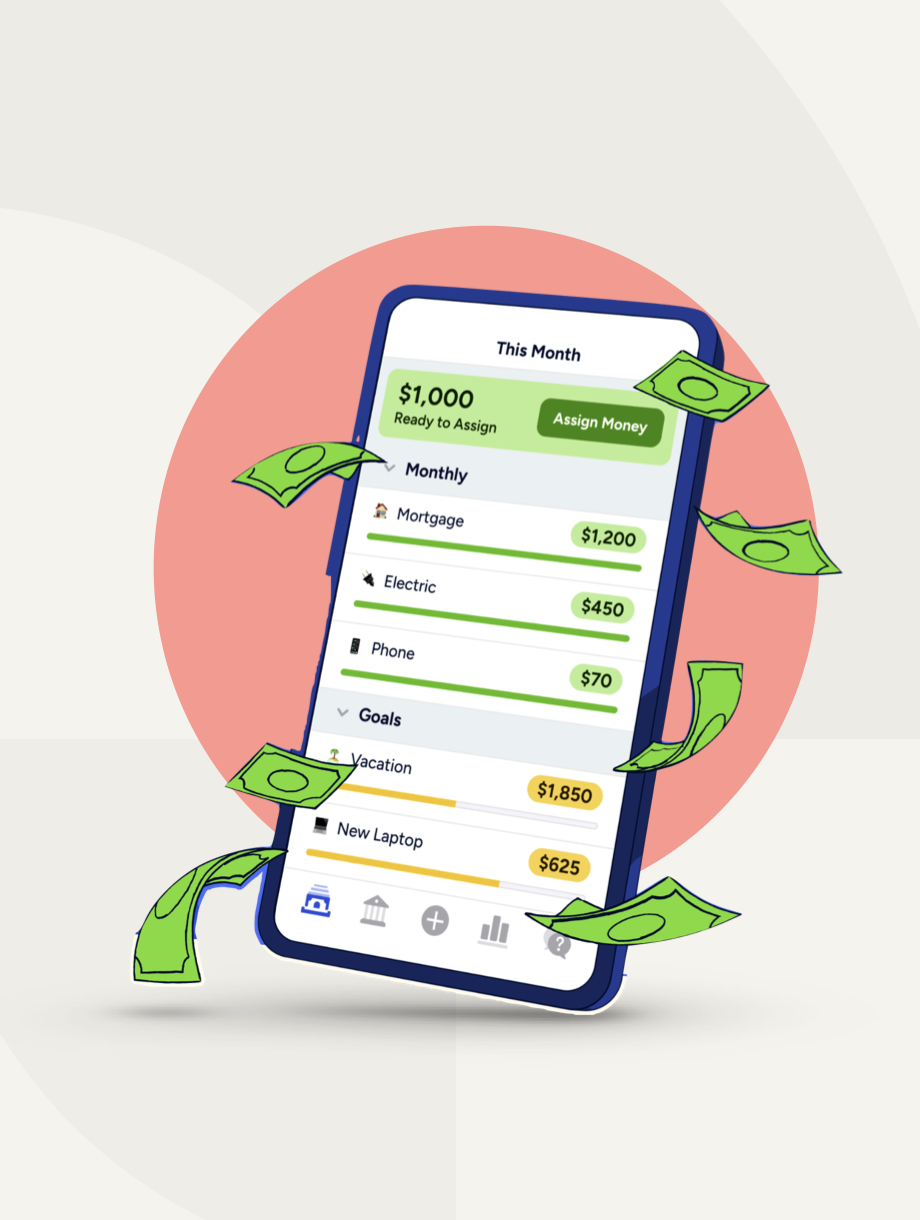

In the fast-paced, digital world of today, budgeting apps such as YNAB (You Need a Budget) have emerged as great tools. YNAB's foundational philosophy is centered around the innovative concept of giving every dollar a specific role, which entails planning for unforeseen events and striving to escape the often stressful paycheck-to-paycheck lifestyle.

By adopting these tools, you can greatly simplify the complexities of budgeting. This, in turn, makes navigating the financial landscape much easier, thereby helping users to more effectively reach their financial objectives, whether that's saving for retirement, preparing for emergencies, or funding a dream vacation. Utilizing such apps can provide a clearer path towards financial stability and success.

Real-Life Success Story: Emily's Journey

Emily's journey is a powerful tale of financial liberation. Once burdened by a growing mountain of debt and a lifestyle that far exceeded her means, Emily found herself at a crossroads. Faced with the daunting task of turning her financial situation around, she made a decisive choice to take control of her finances. By adopting a meticulous approach to budgeting and embracing the principles of YNAB (You Need A Budget), Emily embarked on a disciplined path toward financial freedom.

She meticulously tracked every expense, cut unnecessary spending, and focused on paying off her debts one step at a time. Her dedication and commitment paid off remarkably. Within the span of just one year, Emily not only cleared her debt completely but also succeeded in building a robust emergency fund, safeguarding her future against unforeseen expenses. Emily's story is more than just an account of debt elimination; it is a testament to the transformative power of a well-executed budget and the enduring impact of financial discipline.

Following Expert Guidance

“Budgeting has only one rule: Don’t go over budget.”

- Leslie Tayne

This simple yet powerful piece of advice captures the very essence of effective financial management. It emphasizes the importance of strict adherence to your budget, regardless of the circumstances or temptations you might face. By sticking to your budget, you ensure that your financial goals and plans remain on track, laying a solid foundation for financial stability and success. Seek out expert advice and guidance, whether from a financial professional, budgeting apps, or books like this one, to further enhance your budgeting skills.

The Ripple Effect of Budgeting

Budgeting is a powerful tool that not only significantly improves your financial health but also elevates your overall life satisfaction to new heights. By giving you a clear understanding of your financial inflows and outflows, budgeting effectively reduces financial stress, which is a common source of worry for many.

Furthermore, it plays a crucial role in mending and improving relationships strained by financial disputes, fostering a more harmonious home environment. Most importantly, budgeting acts as a bridge to your dreams, enabling you to set and achieve realistic financial goals that bring you closer to realizing your aspirations, whether it's buying a new home, traveling the world, or securing a comfortable retirement.

Your Financial Freedom Awaits

Remember, the essence of budgeting is not about putting unnecessary constraints on your lifestyle; rather, it's about seizing control and making well-informed decisions that set the stage for achieving financial independence. The key is to start with small, manageable steps, and remain consistent in your efforts. Over time, these small steps will lead to significant changes in your financial landscape, allowing you to witness a transformation that can secure your future.

To embark on this journey, the first actionable step is to gain a solid understanding of your current financial situation. This involves closely examining your income and expenses to identify where your money is going each month. Following this, you can move forward with establishing a budget that suits your needs and goals. This doesn't have to be a complex process; a simple spreadsheet or utilizing a budgeting app like YNAB (You Need A Budget) can be incredibly effective tools. What's most important is that you take that initial step.

Let the stories of people like Jordan and Emily, along with countless others who have successfully navigated their way to financial freedom, serve as your inspiration. These stories underscore that, regardless of your starting point, the journey to financial well-being is possible with determination and the right approach.

Your journey toward financial freedom officially begins with this very first step. It's imperative not to postpone taking action in anticipation of a "perfect" moment. The reality is, the perfect time is now. By deciding to take control of your finances today, you're setting yourself up for a future filled with more security, peace of mind, and gratitude from your future self. Start now, and let each step forward be a building block toward your goal of financial independence.

.png)

.png)