.png)

The Information You Need

As we step into 2024, understanding the intricacies of Social Security becomes increasingly essential, especially for those nearing retirement. This vital program, often the cornerstone of retirement planning, demands strategic decision-making to maximize its benefits.

According to a study by the Social Security Administration, approximately 61% of retired individuals rely on Social Security for at least half of their retirement income. This underscores the significance of this program for many retirees in the United States, serving as a primary source of income during their golden years.

But how does Social Security actually work? And what factors determine the amount of benefits that an individual receives?

As mentioned, Social Security provides retirement income for millions of Americans. But it also serves as a safety net for people with disabilities and for surviving spouses and children. The program is funded through payroll taxes, which are withheld from workers' paychecks throughout their careers.

Bernie Sanders emphasized the value of Social Security, calling it “the most important and valuable social program in the history of the United States.”

Early Application: A Strategic Move

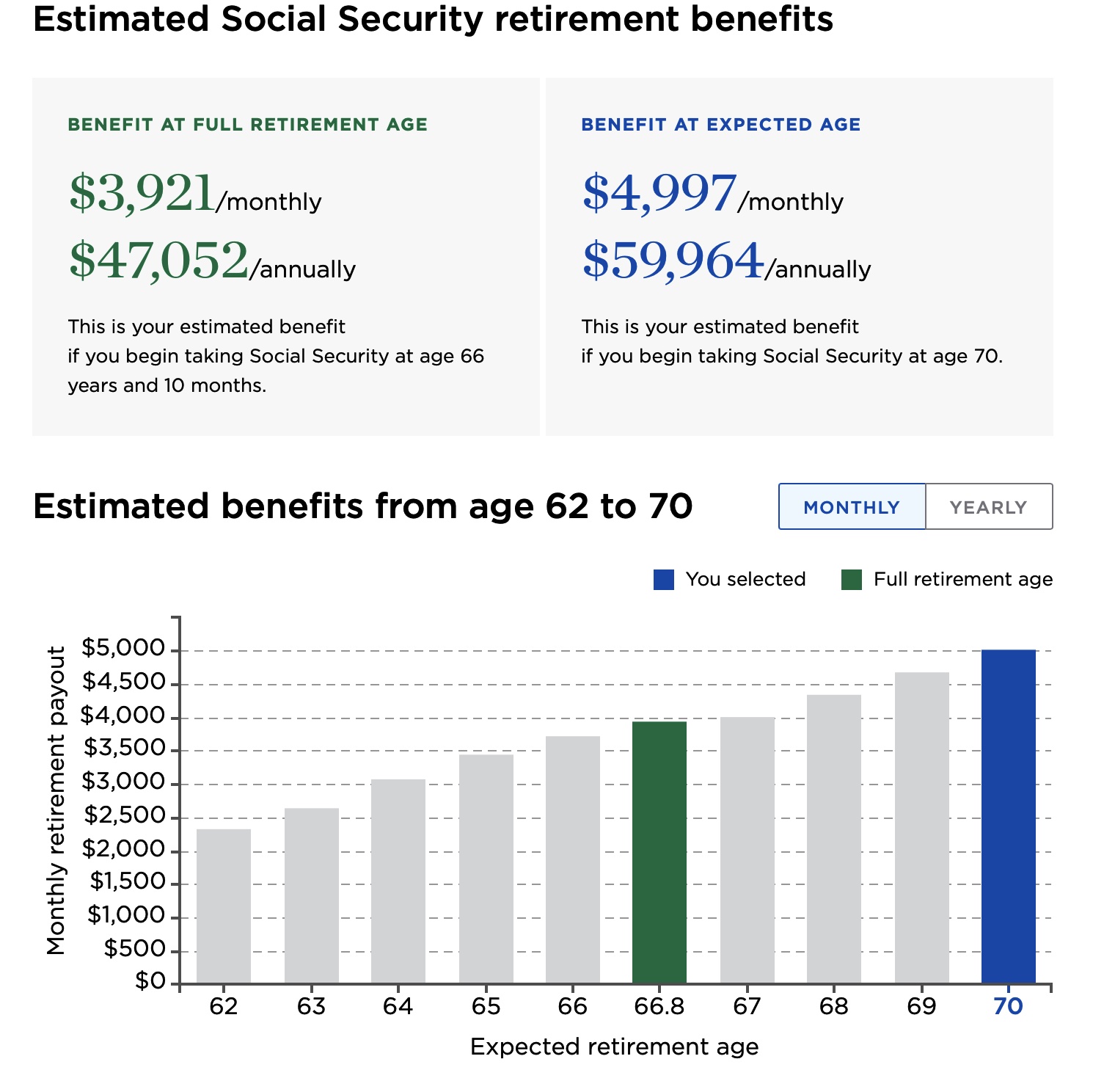

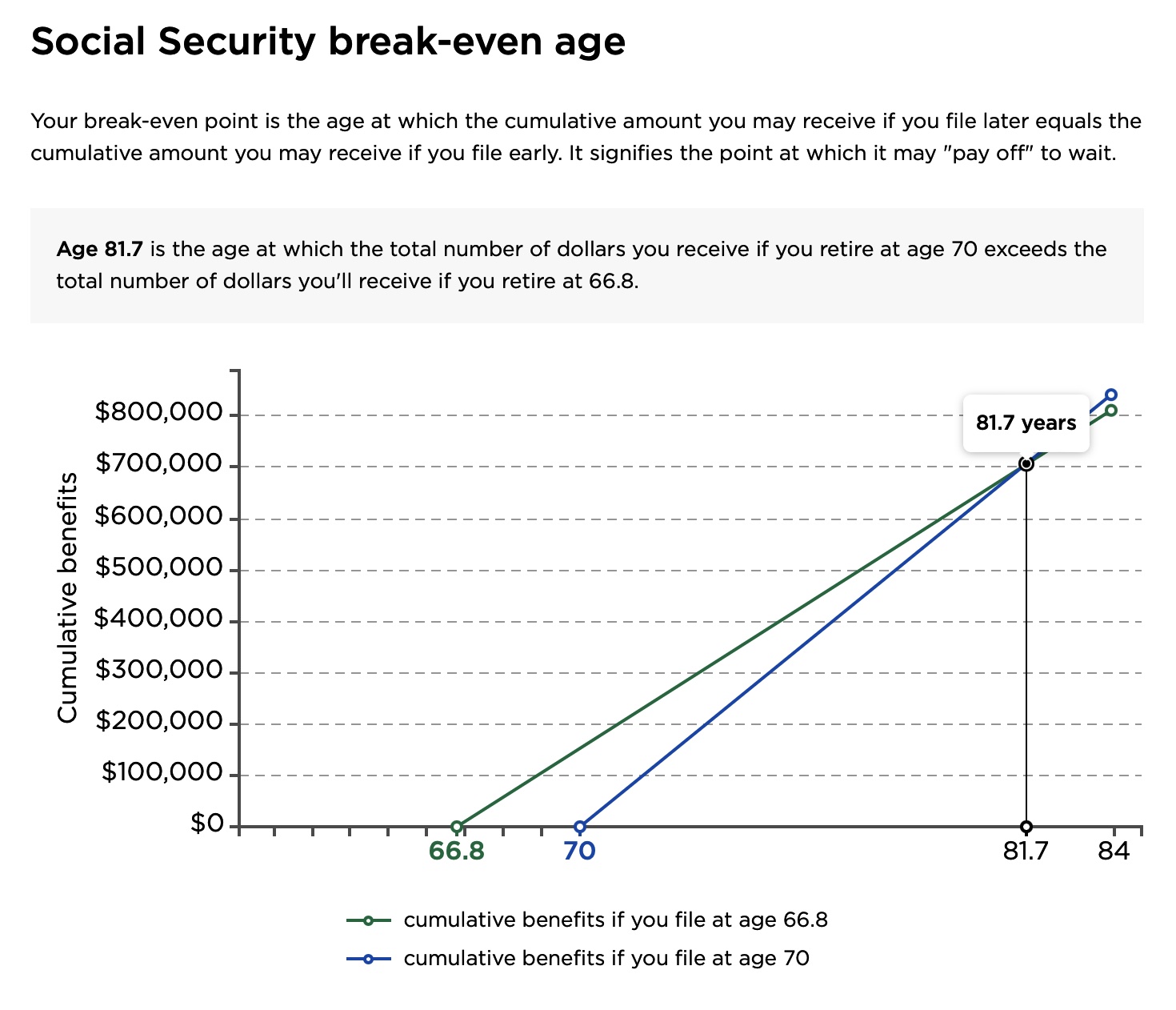

Initiating your Social Security retirement benefits requires a proactive approach. You are eligible to apply up to four months before your intended start date. However, timing is crucial. While you can commence receiving benefits as early as 62, each year you delay (up until 70) significantly increases your monthly payout.

Critical Considerations: When to Start Your Benefits

The decision of when to start receiving Social Security should not be taken lightly. If you opt to receive benefits at 62, you'll face a reduction compared to waiting until the full retirement age (FRA) of 67. Patience pays off; delaying benefits past your FRA can increase your monthly amount until you turn 70.

Payment Schedule: Understanding the Lag

Social Security operates on a delayed payment system. Benefits for any given month are paid in the following month. For instance, September's benefits will be disbursed in October. Your birthday significantly influences your payment schedule:

- 1st-10th of the month: Benefits arrive on the second Wednesday of the following month.

- 11th-20th of the month: Expect your benefits on the third Wednesday of the following month.

- 21st-31st of the month: Benefits are paid on the fourth Wednesday of the following month.

Application Process: A Step-by-Step Guide

Applying for Social Security is a straightforward process, primarily conducted online at ssa.gov. The website offers various applications, encompassing retirement, spousal, disability (SSDI), and Medicare benefits. Alternatively, you can call 800-772-1213 or visit a local office. To expedite the process and reduce wait times, scheduling an appointment is recommended.

Required Documentation: Preparing for Your Application

A successful application necessitates a comprehensive collection of personal and professional information, including:

- Personal details: Birth information, Social Security number, citizenship status, and proofs of birth and U.S. citizenship/work authorization.

- Spouse and children's information: Names, Social Security numbers, birthdates, marriage/divorce/death details.

- Previous Social Security applications, bank account details for benefit deposit, and intended start date for benefits.

- Employment information: Employer details, earnings, W-2 forms or self-employment tax returns, Social Security statement or earnings record, and special work or benefits history.

Which Claiming Age is the Best?

In-depth research conducted by United Income, a prominent online investment management firm, has shed light on the critical question: When is the best age to claim Social Security benefits for maximum lifetime income? This question, crucial for future retirees, intertwines factors like health, marital status, and financial needs, making the decision complex and uncertain.

United Income's groundbreaking study, titled "The Retirement Solution Hiding in Plain Sight," delved into the Social Security claim records of 20,000 retired workers. These records, sourced from the University of Michigan's Health and Retirement Study, date back to 2019. The findings reveal a striking contrast between the common practice of early claims and the actual age that yields the highest lifetime benefits.

The analysis uncovered that only a mere 8% of those who claimed their Social Security benefits between the ages of 62 and 64 made the optimal decision in terms of maximizing lifetime income. On the other hand, a substantial 57% of retirees would have benefited most by waiting until the age of 70 to claim their benefits. While claiming at age 66 does offer a better outcome than claiming at 62, it's still surpassed by the benefits accrued from waiting until ages 67 through 70.

It's important to note, however, that this study does not dismiss the validity of early claims in certain scenarios. Individuals facing chronic health issues potentially reducing their life expectancy may find that claiming benefits early could result in higher overall income. Nevertheless, the overarching message from United Income's comprehensive research is clear: For the majority of future retirees, patience can be a strategic asset in maximizing their lifetime Social Security benefits.

2024 Social Security Updates: What to Expect

Social Security is a dynamic program continually evolving to serve its beneficiaries better. Key changes for 2024 include:

- Cost-of-Living Adjustment (COLA): Beneficiaries will receive a 3.2% COLA, enhancing monthly payouts to counter inflation.

- Varied Full Retirement Ages: Individuals born in 1957 and 1958 will experience different FRAs, impacting when full benefits can be accessed.

- Increased Maximum Benefits: The maximum benefit for high-income earners retiring in 2024 has risen, reflecting recent inflation trends.

- Higher Payroll Taxes for Top Earners: The wage base for Social Security payroll taxes has increased, affecting high-earning employees and self-employed individuals.

Empower Your Retirement: Staying Informed

Maximizing your Social Security benefits requires staying informed and making strategic decisions. Regularly monitoring your Social Security status and understanding annual changes are crucial steps in ensuring you receive the full financial support the program aims to provide. As 2024 unfolds, let this be your guide to navigating Social Security with confidence and clarity.

.png)

.png)