.png)

Unlock the Power of Compounding

In the world of personal finance, understanding the power of compound interest is crucial for making informed decisions. One valuable tool for grasping its implications is the Rule of 72, which offers a brilliantly simple way to estimate the time it takes for an investment to double. But did you know that this rule is equally insightful when considering the impact of borrowing?

Let's dive deeper into how the Rule of 72 can work both for you and against you, using real-world data as of December 2023. By exploring concrete examples and scenarios, we can gain a clearer understanding of the potential long-term effects on your financial goals. So buckle up as we delve into the details and uncover the fascinating dynamics of this mental math shortcut, The Rule of 72!

How the Rule of 72 Works

The Rule of 72, a simple and useful formula, provides an estimate of the time required for an investment to double. By dividing the number 72 by the annual rate of return or interest rate, you can obtain an approximate number of years it will take for your investment to double its initial value.

This rule is commonly employed by consumers as a quick assessment tool to evaluate the potential growth of their investments and make informed decisions about their financial goals.

By understanding the Rule of 72, you can better strategize and plan your investment portfolios, considering factors such as risk tolerance, time horizon, and desired returns.

When You Save: A Slow Climb

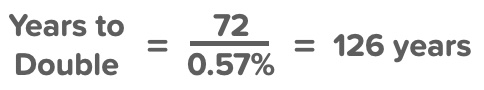

The national average Annual Percentage Yield (APY) for savings accounts currently stands at 0.57%1 as of December 2023. This means that for every $1,000 you save, you could expect to earn approximately $5.70 in interest over the course of a year.

Using the Rule of 72, which states that you can estimate the number of years it takes for your money to double by dividing 72 by the interest rate, we can see that it would take around 126 years for your savings to double at this rate.

This calculation unveils a stark reality: at the current rate of growth, it would take a staggering 126 years for your savings to double. This emphasizes the slow and sluggish nature of money's growth in traditional savings accounts, further underscoring the urgent need for more effective investment strategies.

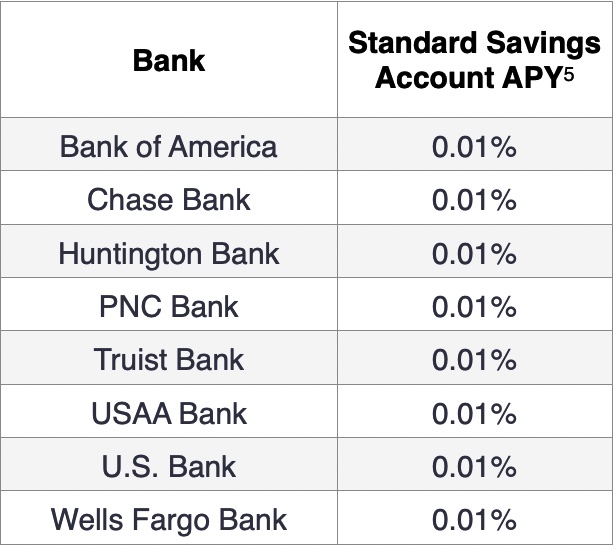

The Impact of Low-Interest Rates

Now, let's contrast these figures with the reality of many traditional banks. Despite the national average for savings account APY being 0.57%, a significant number of bigger banks are offering meager interest rates as low as 0.01%.5

Applying the Rule of 72, this would theoretically require an astonishing 7,200 years for the amount to double. It's a sobering reminder of the importance of carefully considering where and how you decide to save and invest your money.

82% Overlook The Opportunity for Growing Wealth

As you can see, it’s not uncommon for bigger banks to offer lower savings account rates, as they have less need to attract new customers for deposit accounts. To truly outpace inflation and achieve substantial wealth accumulation over time, it’s crucial to explore alternative investment avenues that offer higher returns and greater financial opportunities.5

When it comes to saving money, many Americans are missing out on a fantastic opportunity to grow their savings with minimal risk. High-yield savings accounts can offer attractive interest rates, currently exceeding 5%, which is almost 10x higher than the national average for traditional savings accounts. Shockingly, a recent CNBC Select and Dynata Banking Behaviors Survey3 revealed that a staggering 82% of the population does not take advantage of these accounts.

The significance of this is clear - countless Americans are unknowingly forfeiting the chance to earn free money. Consider this: according to the Federal Reserve4, the average American family holds approximately $8,000 across various bank accounts, including checking and savings. If this amount were to earn the current average 0.57% APY in a traditional savings account, the total interest earned in a year would be a meager $46. Of course, this is far superior to the meager $0.80 you would have earned from one of the banks offering a negligible 0.01% APY. Conversely, if the same amount were deposited into a high-yield savings account earning 5.0% APY, the interest earned would exceed $400 for the same timeframe.

It is evident that by neglecting high-yield savings accounts, Americans can miss out on a significant opportunity to maximize their savings and make their money work harder for them.5

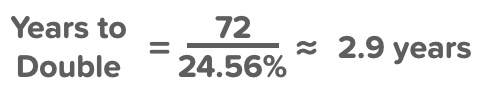

When You Borrow: A Fast Descent

The national average Annual Percentage Rate (APR) for new credit cards currently stands at a staggering 24.56%2 as of December 2023. This means that for every $1,000 balance you keep, you can expect to pay approximately $246 in interest over the course of a year.

Taking into account factors such as interest charges and fees, the APR provides a comprehensive understanding of the financial implications associated with credit card usage. By gaining a deeper insight into this significant metric, you can make more informed decisions when it comes to managing your finances and choosing the most suitable credit card options.

In less than three years, the amount you owe could double, compounding the urgency and illustrating the alarming speed at which debt can grow. This serves as a critical reminder of the perils of high-interest debt, emphasizing the importance of managing credit responsibly and taking proactive steps to mitigate its impact on financial well-being.

By adopting sound financial practices, such as budgeting, saving, and making timely payments, Americans can safeguard themselves against the detrimental effects of mounting debt and pave the way for a more secure and stable future.5

A Tale of Two Candies: Dum-Dums and Smarties

Banks often go the extra mile to offer small tokens of appreciation to their customers, such as delicious candies. Interestingly, one common choice that catches the eye is Dum-Dums lollipops. At first glance, it might seem like a simple and innocent gesture, but if we delve deeper, we can uncover a subtle metaphor that reflects the financial choices we encounter in our lives.

What's intriguing is that Dum-Dums are manufactured by the same company, Spangler, that produces another popular candy, Smarties. This stark contrast between the two candies serves as a powerful symbol, representing the decisions we make when it comes to our finances.

On the one hand, Dum-Dums represent the allure of financial complacency, where we may be tempted to make unwise choices without considering the long-term implications. On the other hand, Smarties embody the essence of smart and informed financial decisions, highlighting the importance of making choices that align with our goals and aspirations.

By offering these seemingly insignificant candies, banks remind us of the profound impact our financial decisions can have on our lives. It encourages us to reflect on the choices we make and strive to be more conscious and intentional in our financial journey.

For Savers: Seek Better Returns

Given the historically dismal returns on traditional savings accounts, it's crucial for consumers to explore other investment avenues that have the potential to generate higher returns over the long term.5 One such avenue to consider is low-cost index funds, which are designed to track the performance of a specific market index and offer diversification benefits.5

Additionally, investing in individual stocks or bonds can provide opportunities for higher returns, although they may come with higher risks.5 By diversifying your investment portfolio across different asset classes, you can increase your chances of achieving your financial goals and building long-term wealth.5

For Borrowers: Manage and Reduce Debt

If you carry high-interest debt, especially on credit cards, it is crucial to prioritize paying it off as soon as possible. One effective strategy to consider is debt consolidation, which involves combining multiple debts into a single loan with a lower interest rate.5

Another option is transferring balances to lower-rate cards, which can help reduce the overall interest charges and make it easier to pay off the debt faster. By taking these proactive steps, you can regain financial control and save money in the long run.5

Educate and Empower Yourself

Knowledge is a powerful asset that can greatly impact your financial decisions. By familiarizing yourself with tools like the Rule of 72, you gain a deeper understanding of how money works and can make smarter choices. It's important to seek financial education and advice to further enhance your financial literacy.

Remember, whether you choose the path of the Dum-Dums (those who lack financial knowledge) or the Smarties (those who make informed decisions), the choice is ultimately yours to shape your financial future.

The Rule of 72 is more than just a mathematical shortcut; it's a powerful tool that provides valuable insights into your financial decisions. By comprehending the dynamics of how money can either work for you or against you, you gain the ability to take control of your financial future.

With this knowledge, you can make informed choices that pave the way for prosperity and ultimately lead to lasting financial freedom. So, embrace the Rule of 72 as a guiding lens, empowering you to navigate the intricacies of personal finance with confidence and success.

- Average Savings Account Rate 12/13/2023: https://www.bankrate.com/banking/savings/average-savings-interest-rates/

- Average New Credit Card Rate 12/13/2023: https://www.lendingtree.com/credit-cards/average-credit-card-interest-rate-in-america/

- CNBC Savings Article https://www.cnbc.com/select/americans-not-using-high-yield-savings-accounts/

- Federal Reserve Survey of Consumer Finances: https://www.federalreserve.gov/econres/scfindex.htm

- The information provided is for educational and informational purposes only and should not be construed as financial advice. The discussion about the impact of low savings account interest rates and the opportunities for growing wealth through alternative investment avenues, including high-yield savings accounts, and high credit cards rates, reflects general market trends and data available 12/13/2023. Individual financial situations and goals may vary, and it's crucial to consult with a qualified financial professional before making any savings, investment or credit decisions. The examples and data cited, including interest rates and survey results, are illustrative and may not represent current market conditions. Readers should conduct their own research and consider their financial circumstances and risk tolerance before investing.

.png)

.png)