.png)

Exploring the Unseen Impact of Inflation on Your Finances

In the world of personal finance, where numerous factors play a crucial role in shaping your financial future, one often overlooked companion stands out: inflation. Inflation, an economic phenomenon characterized by the gradual increase in the prices of goods and services over time, wields a significant influence over the economic landscape.

It can erode the purchasing power of money, affecting everything from the cost of living to investment returns.

Understanding the implications of inflation is paramount for making informed financial decisions and safeguarding your financial well-being in the long run.

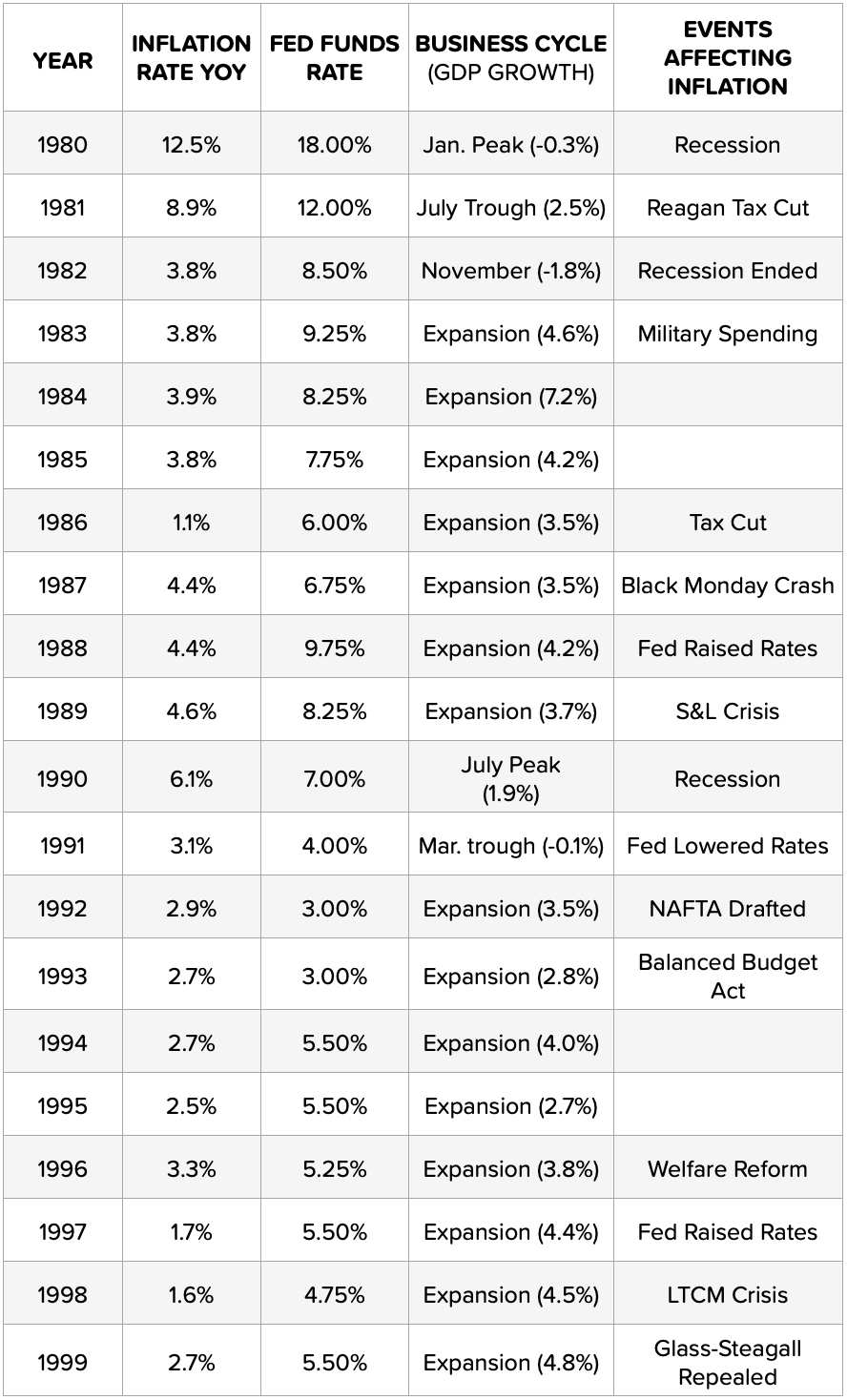

Four Decades of Inflation

Over the past 40+ years, inflation rates in the U.S. have exhibited a downward trend with moderate fluctuations. In the early 1980s, the country experienced high inflation, with rates soaring over 13%. This was partly due to the Federal Reserve's effort to quell the rapid inflation of the 1970s. The remainder of the decade witnessed a steady decline, with inflation averaging around 4% by the late 1980s.

Moving into the 1990s, inflation rates remained relatively stable, hovering around 2-3%. This period of low inflation, coupled with economic expansion, is often referred to as the “Great Moderation.”

The turn of the millennium brought with it the dot-com bubble burst and the 2008 financial crisis, causing temporary spikes in inflation. However, the overall trend remained stable, with inflation rates predominantly in the 1-3% range.

In the 2010s, despite the economic recovery, inflation remained low, even dipping below 1% at times.

As we move through the decade of the 2020s, it’s worth noting that inflation rates have witnessed significant volatility due to the far-reaching economic repercussions triggered by the unprecedented COVID-19 pandemic. The global health crisis has upended economies worldwide, leading to fluctuations in inflation rates as governments and central banks grapple with the challenges of stabilizing their respective economies and supporting businesses and individuals during these uncertain times.

The Impact of Inflation on Your Finances

While low and stable inflation is generally beneficial for economic growth, it can have a significant impact on your personal finances. One of the most significant effects of inflation is its erosion of purchasing power over time. In simpler terms, the same amount of money will buy you less in the future due to rising prices.

For example, let's say you have $10,000 in a savings account earning 2% interest. If the inflation rate is also at 2%, your money will essentially stay the same in purchasing power. However, if inflation increases to 4%, your savings will only be worth around $9,500 in today's dollars after one year.

This is why it is crucial to consider inflation when making financial decisions, such as investment choices and budgeting for the future. It's like a quiet breeze that is constantly present, subtly impacting the economy and affecting the purchasing power of individuals. Understanding the dynamics of inflation and its implications is crucial for making informed financial decisions and planning for the future.

How Inflation Works: A Tale of Two Coffees

Let's illustrate the concept of inflation with a simple story. Imagine, ten years ago, you could walk into your favorite coffee shop and purchase a steaming cup of your beloved coffee for just $2. Fast forward to today, and that same cup of coffee now costs $3.50. This increase in price is a direct result of inflation, which refers to the general rise in prices over time.

Essentially, what inflation means is that the purchasing power of your money decreases as time goes on. In other words, the dollar in your pocket today won't be able to buy you as much as it could a few years down the line. This is why it's important to understand inflation and its impact on our daily lives. By staying informed and making wise financial decisions, we can navigate the ever-changing economic landscape and make the most of our hard-earned money.

Inflation and Your Finances: A Balancing Act

Inflation impacts every aspect of your finances, from savings to investments to debts. If you're saving money, inflation acts as a silent thief, eroding the future value of your savings. For instance, if you stash $10,000 in a box today, it might only have the buying power of $7,000 or less in 10 years, depending on the rate of inflation.

However, it's not all gloomy. Inflation can actually work in favor of those who have long-term fixed-rate debts, such as a mortgage. Here's why: When you lock in a mortgage at a fixed rate, the amount you pay remains constant.

As inflation rises, the real value of what you pay back decreases. This means that over time, you effectively end up paying back less in real terms than what you initially borrowed. So, while inflation may seem like a negative force, it can actually benefit those who have fixed-rate debts in the long run by reducing the real burden of repayment.

The Investment Balancing Act

The key to combating inflation lies in making wise investments. Historically, stocks have proven to be an excellent investment option, offering returns that have consistently outpaced inflation. Additionally, real estate investments can serve as a valuable hedge against inflation.

As property values and rents tend to rise in tandem with inflation, investing in real estate can help preserve the purchasing power of your assets over time. By diversifying your investment portfolio and considering these options, you can effectively protect your wealth from the erosive effects of inflation.

A Cautionary Tale

Consider the story of Emily, who saved $20,000 in her bank account over 20 years ago. She felt secure, believing her nest egg would suffice for her retirement. However, she didn't account for inflation. Now, her $20,000 has the same purchasing power as around $12,000 had two decades ago. Emily's story teaches us the importance of accounting for inflation in our long-term financial planning.

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.”

– Sam Ewing

Embracing the Silent Partner

Inflation, the persistent rise in prices over time, is an inescapable and crucial aspect of our financial lives. It has the potential to work against us, eroding the purchasing power of our money. However, by comprehending and planning for inflation, we can mitigate its impact and safeguard the value of our hard-earned money.

Developing financial literacy entails not only acquiring the knowledge of how to generate income but also understanding the strategies to preserve its value in the face of inflationary pressures. By taking proactive steps to account for inflation, we can navigate the ever-changing financial landscape with confidence and resilience.

A Call to Action

Educate yourself about inflation, the gradual increase in prices over time. It's important to understand its impact on your savings and investments. By adjusting your strategies to outpace inflation, you can ensure the growth of your financial portfolio. Embrace inflation as a silent partner, one that challenges you to be proactive, creative, and strategic in your financial journey.

Stay informed about economic trends, explore diverse investment options, and make well-informed decisions to navigate the ever-changing financial landscape. Remember, by staying ahead of inflation, you can protect your purchasing power and achieve long-term financial success.

Thriving in an Inflationary World

While inflation, the gradual increase in prices over time, is an unavoidable companion in our financial journey, it doesn't have to be a formidable foe. By understanding the factors that drive inflation, such as changes in the money supply, demand-pull, and cost-push factors, we can gain a deeper insight into its impacts on our economy.

“Plan for inflation: it's not just a challenge, but an opportunity to grow smarter, stronger, and more resilient in your financial journey. Remember, the best time to plant a tree was 20 years ago. The second best time is now. Start planning, start investing, start defeating the silent partner that is inflation.”

- Tom Mathews

Implementing effective strategies, such as diversifying our investments, hedging against inflation, and adjusting our spending habits, can help us navigate the challenges posed by inflation. By doing so, we not only turn this silent partner into a catalyst for smarter financial planning but also pave the way towards a more secure and resilient financial future.

With careful consideration of investment options, diversification, and staying informed about economic trends, we can navigate the impact of inflation and ensure that our hard-earned money retains its value and grows over time. Remember, being proactive in managing inflation is a key component of long-term financial success.

The best way to compare inflation rates is to use the end-of-year consumer price index (CPI), which creates an image of a specific point in time.

The table below compares the inflation rate (December end-of-year) with the fed funds rate, the phase of the business cycle, and the significant events influencing inflation.

Turning Inflation from Foe to Ally

Inflation is not just an economic concept, but a living, breathing aspect of our financial realities. It's an uninvited guest at every financial decision we make, but understanding and planning for it transforms this potential adversary into a powerful ally.

We cannot control the winds of economic change, but we can adjust our sails. It's time to embrace the challenge. Educate yourself about inflation and its effects. Review and adjust your savings and investment strategies to not just withstand, but also outpace inflation. Seek advice from financial experts, leverage tools and resources available to you, and stay informed about economic trends.

Your call to action is clear: Start today. Reevaluate your financial plans with an eye on inflation. Invest in knowledge, in assets that historically beat inflation, and in strategies that can secure your financial future. Remember, the best time to take control of your financial journey was yesterday; the next best time is now.

Together, we can turn the silent challenge of inflation into an opportunity for growth, security, and financial success. Let's take this journey not as passive observers, but as active, informed participants shaping everyone’s financial destinies.

.png)

.png)