Currently, only 26 states require a personal finance class for high school graduation.

National Endowment for Financial Education, “Respect Legislative Intent with Youth Financial Education Requirements,” Billy J. Hensley, Aug 2024

More than 30% of Gen Z and Millennials say their personal financial worries have been a distraction at work.

LIMRA, “Financial Literacy Month: Helping Gen Z and Millennial Consumers Navigate Today’s Financial Landscape,” Apr 2024

Three-fifths of Gen Z and Millennials say there are financial topics they want trustworthy advice on but aren't sure how to get.

CFP Board, “What Financial Planners Should Know About Millennials and Gen Z Clients,” Apr 2022

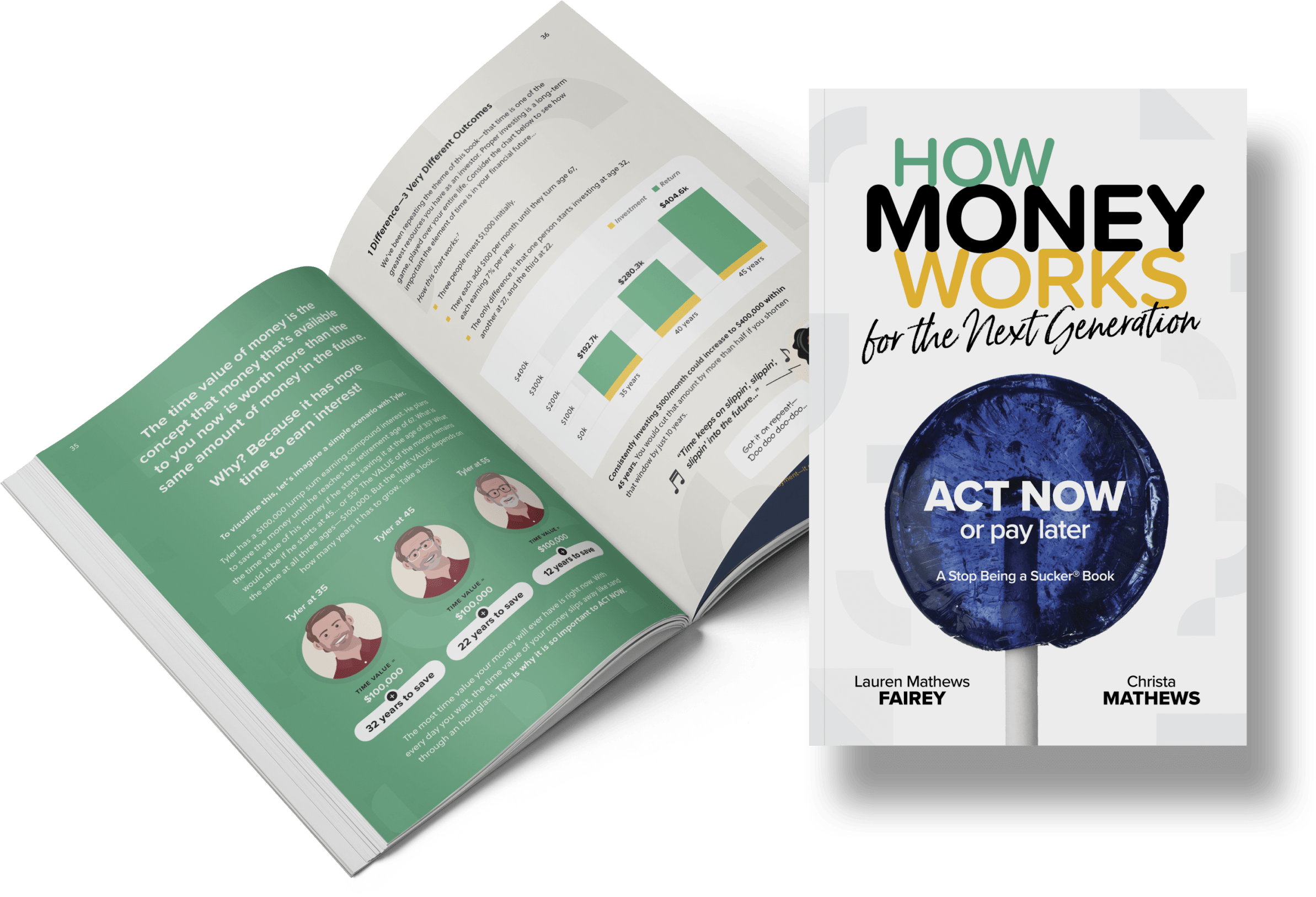

The book addresses specific financial topics young adults are seeking today including...

Basic financial concepts, like how interest works

How to manage debt, get financially stable, start saving for the future, and build wealth

Financial decisions to make starting a new job or changing careers

Merging and managing finances when getting married

Understanding how taxes will impact you today and tomorrow

Checklists to consider when buying a first car and first home

How to set up your children for financial success at a young age

About the Authors

Lauren Mathews Fairey

Lauren Mathews Fairey, in her early 30’s, is a dedicated advocate for financial literacy and a voice for the next generation. A Georgia College & State University graduate with degrees in Management and Marketing, Lauren developed her leadership skills through student government, her sorority, being a tour guide, and as a Student Ambassador. Her career began at one of the world’s largest leadership conferences, followed by marketing roles where she helped grow small businesses and became Chief Marketing Officer. This ultimately led her to her passion for financial education. As a Certified Financial Educator®, Lauren teaches young adults and professionals how money works. Running her WealthWave business and contributing to HQ marketing, Lauren co-hosts WealthWaveLIVE with her sister, Christa, and the WealthWaveNOW podcast, sharing strategies nationwide. Featured in The Wall Street Journal, she’s known for making financial concepts relevant and empowering. Lauren lives in Canton, GA, with her husband Taylor and their three children. Her mission: to inspire the next generation to ACT NOW and take control of their finances to build the future they deserve.

Christa Mathews

Christa Mathews is a leader in financial education for young adults and families, known for her relatable approach to a vital life skill. In her late 20’s, she has already built a reputation as a trusted advocate for empowering the next generation with financial literacy. A graduate of Georgia College & State University, Christa honed her leadership and creativity skills as a Tour Guide, Student Ambassador, and event photographer. After graduating, she joined WealthWave’s HQ team, developing innovative digital marketing and content strategies to connect with younger audiences. Licensed as a Certified Financial Educator®, Christa simplifies financial concepts for emerging generations and mentors professionals on using digital tools to promote financial literacy. As a co-host of WealthWaveLIVE, a guest on major TV networks, and host of WealthWaveNOW podcasts, Christa inspires audiences nationwide. Also an experienced photographer, Christa infuses her teachings with the same vision and clarity she brings to her lens, inspiring others to envision and shape their financial futures

with confidence.Christa’s mission is to equip young adults with the tools they need to overcome financial challenges, take control of their money, and create the lives they deserve.

Financial Educators Weigh In

This book isn’t just about learning how money works—it’s about learning how your money can work for you. Starting early isn’t optional; it’s essential for building a life of freedom.

Financial literacy is the ultimate equalizer, and this book hands that power to the next generation. It’s not just a guide; it’s a game plan for success.

Everything I’ve built by my 30s was possible because of the principles in this book. If you want to finish your 20s and 30s ahead, start with these lessons today.

A book that feels more like an adventure than a book.

Over 160 full-color, custom designed pages with bright, vivid imagery.

Includes a cast of characters who are full of personality and ideas to share.

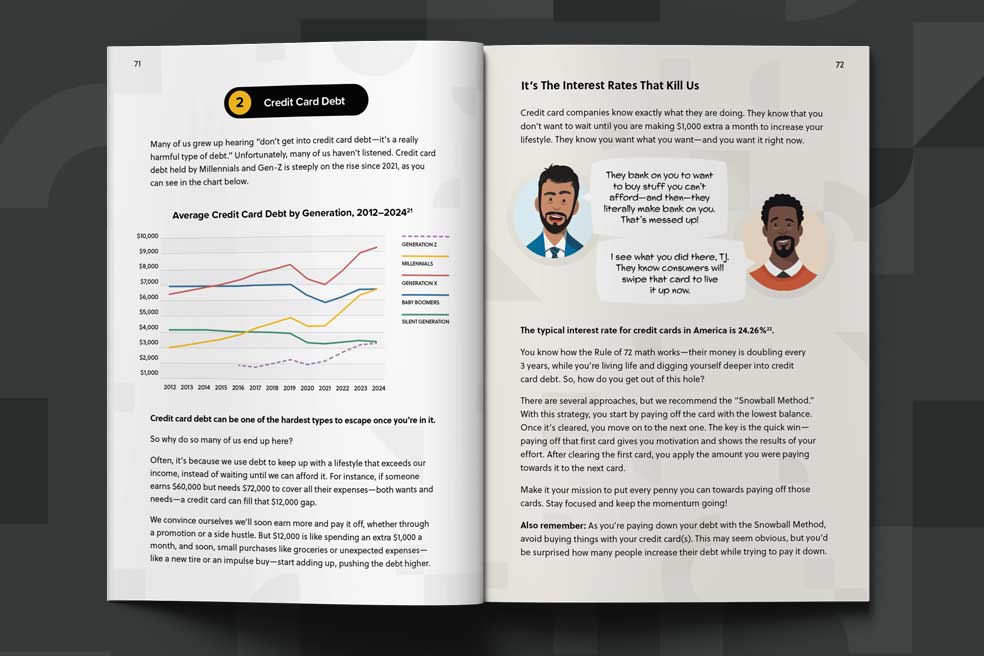

Rich with informational charts and easy to understand examples and illustrations.

Provides a resource manual for readers to use as a guide and roadmap for their financial goals.

The book guides young adults from knowledge to insight to action, offering a clear formula for mastering personal finances.

Realities

Financial literacy is a right, yet schools don’t teach how money works. The Realities section reveals the cost of financial ignorance and the urgency to act now—because if you don’t, you’ll pay later.

Concepts

Learn how Compound Interest, the Time Value of Money, and the Rule of 72 can turn small steps today into big financial gains tomorrow. Master these principles and build your financial future!

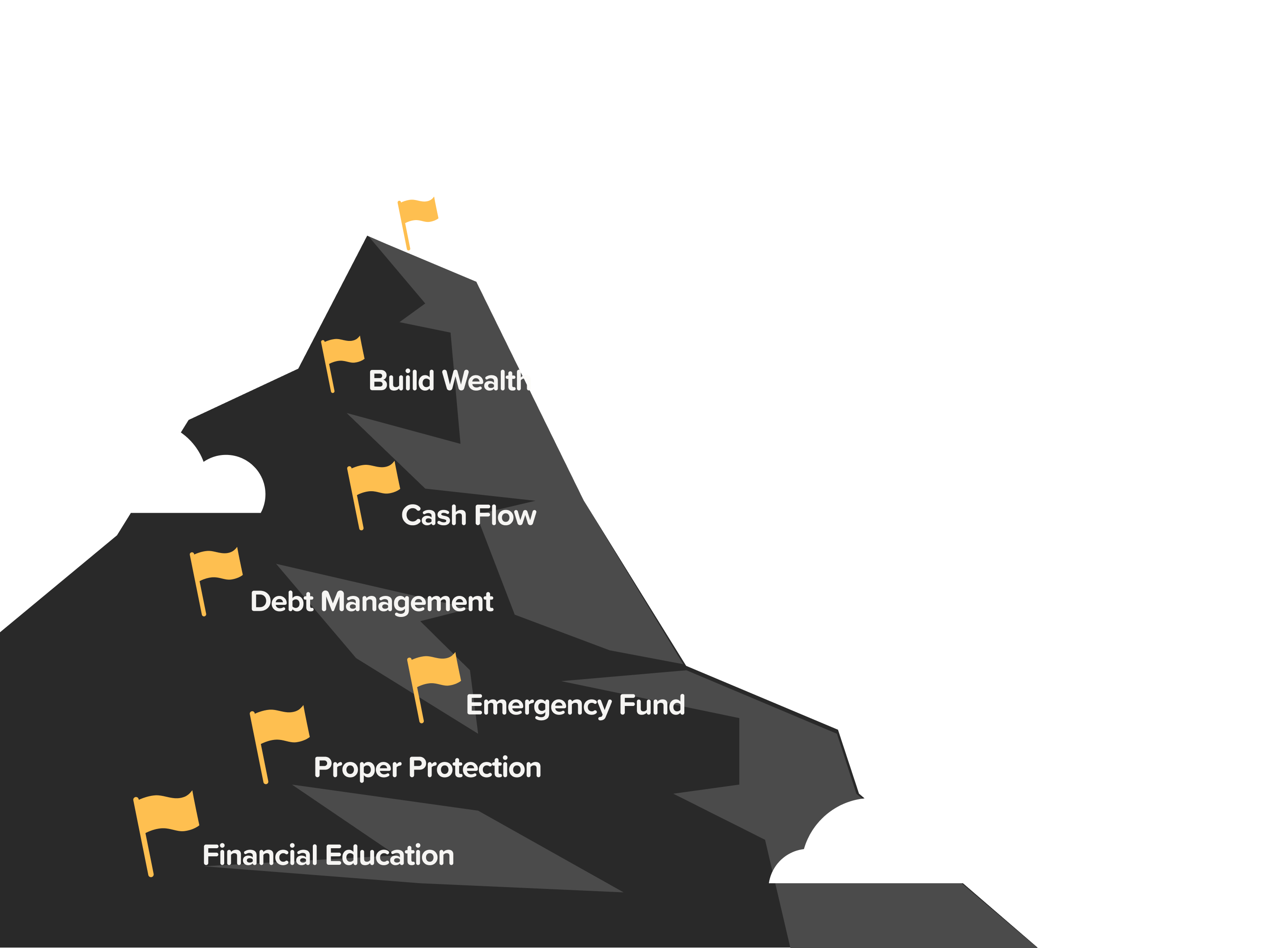

Milestones

The book’s seven action steps are so powerful in cutting through financial noise that we call them Money Milestones. They create a clear roadmap to guide young adults toward lasting wealth and financial freedom.

Firsts

From your first car to your first home and starting a family, this book equips you with vital insights to avoid costly mistakes and navigate your path confidently.

Meet the Cast of Characters

Throughout the book, a charming cast of characters share heartfelt insights and engaging conversations, answering the very questions readers are eager to ask.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Learn how to weave the

7 Money Milestones

into your financial journey.

Each character’s story and chapter represents important issues women can face throughout their lives. Knowledge leads to action, and action leads to greater financial security, well being, and control. The 7 Money Milestones provide a practical path for every woman to follow.

.svg)

.svg)

Learn how to weave the

7 Money Milestones into your financial journey.

The book’s core message is to take action now, emphasizing that young people have the greatest advantage—time—to build their financial future. The Milestones provide a clear, proven roadmap to guide readers step by step toward financial independence and long-term security.

.svg)

Don’t have the book yet?

.png)

.png)

.png)