Women earn just 82 cents for every $1 earned by a man.

U.S. Census Bureau, “Women Consistently Earn Less than Men,” Earlene K.P. Dowell (Jan 27, 2022).

.svg)

By 2030, women are expected to control $30 trillion of the financial assets in the U.S., about 2/3rds of the entire wealth of the nation.

Morgan Stanley, “Women, Wealth and Investing – A Story of Evolution,” Elizabeth Dennis (Jun 28, 2022).

80% of men die married.

80% of women die single.

Transamerica, “The Future of Wealth is Female,” (2021).

.png)

.svg)

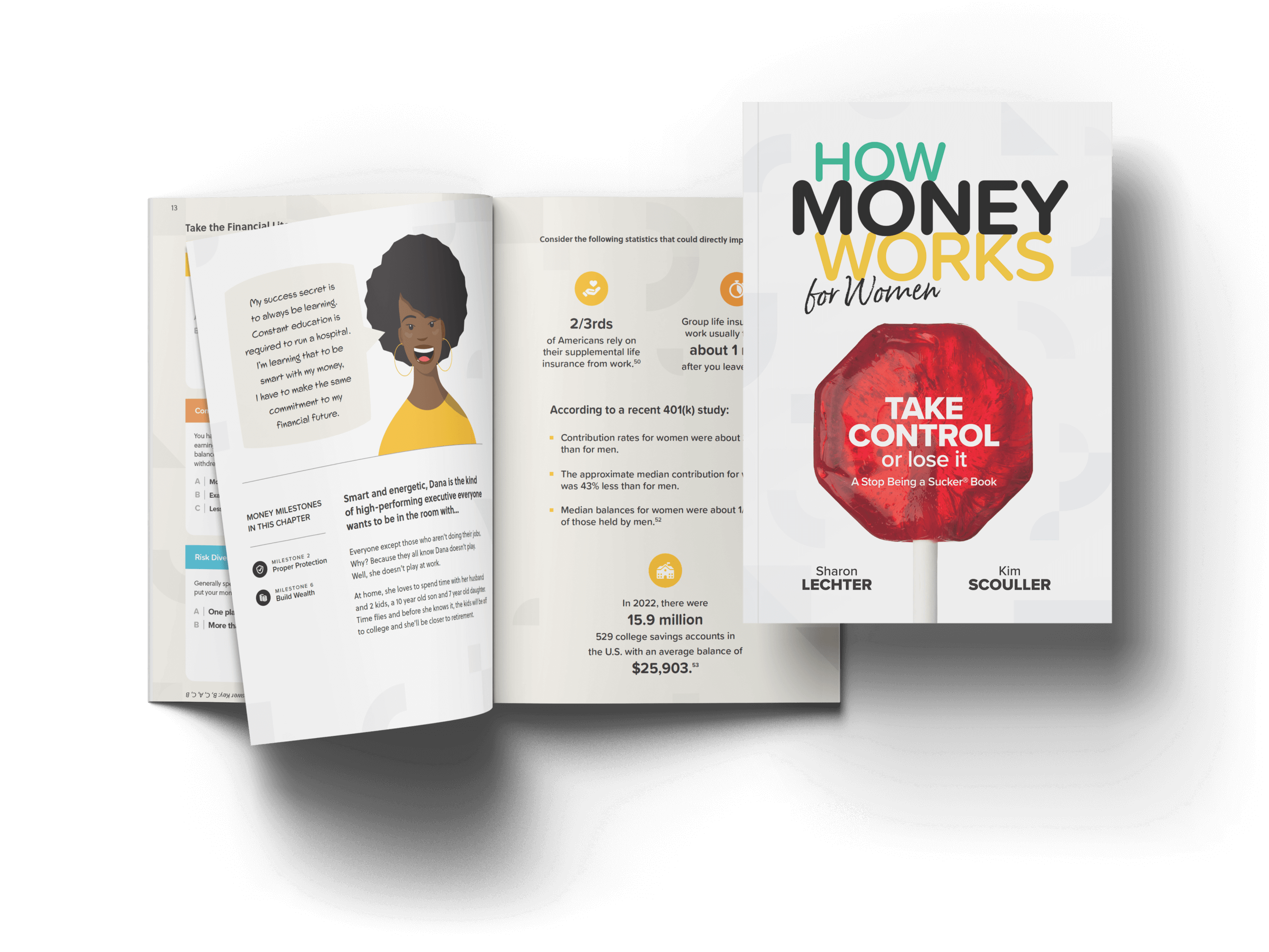

The book addresses specific issues women encounter like...

Pay inequality

Juggling college planning and

retirement savingsDomestic violence and financial abuse

Caring for special needs children

When to claim social security

Taking primary responsibility for finances after the death of a spouse

and many others...

About the Authors

.png)

Sharon Lechter

Sharon is internationally recognized as a financial literacy expert, keynote speaker, and business mentor. She is a New York Times bestselling author, successful entrepreneur, philanthropist, and enjoyed her career as a CPA. She advised two U.S. Presidents on the topic of financial literacy and co-authored the international bestseller Rich Dad Poor Dad and 14 other books in the Rich Dad series. In 2008, Sharon was asked by the Napoleon Hill Foundation to help re-energize his teachings. Her best-selling books with the Foundation include Three Feet from Gold, Outwitting the Devil, Think and Grow Rich for Women, and Success and Something Greater. She is also featured in the movie Think and Grow Rich: The Legacy and on the national television series World’s Greatest Motivators. She lives in Scottsdale, Arizona with her husband, Michael Lechter.

.png)

Kim Scouller

Kim is recognized as a leading advocate for women and their finances. She has been an attorney for more than 30 years and served as in-house counsel for one of the largest financial services companies in the world. During her tenure at Transamerica, she served in several executive roles for the company’s insurance affiliates, broker-dealers, mutual funds, and investment advisors. In her last four years there, she served as the president of the Transamerica broker-dealer with the largest number of registered representatives. As one of the few women broker-dealer presidents in the U.S., she traveled around the country talking with people, especially women, about the steps to identify and achieve their financial goals. Wanting more control over her time, Kim left her corporate career to start her own financial business and law firm based in the Atlanta area. A Certified Financial Educator®, Kim continues to speak with women about the importance and impact of financial education that leads to literacy. She lives in Alpharetta, Georgia with her family.

Financial Educators Weigh In

.svg)

No other financial publication for females answers the Why and How for taking control of your personal finances better than this incredibly self-empowering, educating and energizing book.

.svg)

Finally, a book that talks about a woman’s journey with money with an eye-opening educational format.

.svg)

Learning how money works is the great equalizer. You will recognize yourself on the pages of this book. The stories and money tools are so powerful. Ladies, the message in this book is clear!... It is up to us to learn How Money Works and it is up to us to Pass It On.

.png)

An easy, engaging read from cover to cover.

.png)

Over 160 full-color, custom designed pages with bright, vivid imagery

.png)

Includes a fun cast of women characters readers of any age can connect with

.png)

Easy, breezy read with helpful tips and checklists to help readers take action

.png)

Filled with practical, actionable material you can reference over and over again

.svg)

The format of the book makes sense from realities and concepts to practical knowledge and actionable steps.

Realities

The beginning of the book centers on shocking statistics that paint a picture of the unique challenges women face with respect to their money.

Concepts

The book continues with the basic concepts everyone should know to build a sound financial foundation, like the Rule of 72.

Milestones & Characters

The book then artfully weaves the narratives of nine distinct characters, each grappling with the circumstances unique to their age and life stage. In each chapter, our actionable steps—The 7 Money Milestones—unfold with practical clarity.

Meet the Cast of Characters

Throughout the book, the charming and formidable women characters below help illustrate real world challenges and circumstances women face at different ages and stages of life.

%20(1).png)

Learn how to weave the

7 Money Milestones

into your financial journey.

Each character’s story and chapter represent important issues women can face throughout their lives. Knowledge leads to action, and action leads to greater financial security, well being, and control. The 7 Money Milestones provide a practical path for every woman to follow.

.svg)

.png)

Don’t have the book yet?

.png)

.svg)

.png)

.png)

.png)

%20(1).png)

.svg)

.svg)

.svg)

.svg)

.svg)