Request a copy of our book(s)

Request a copy of our book(s)A Tidal Wave of Wealth Is Coming

How Each Generation Will Be Changed by the Great Wealth Transfer

We are standing at the edge of one of the most significant financial shifts in history. Analysts project that approximately 124 trillion dollars in assets will pass from older generations to heirs and charitable causes by 2048. The majority of these assets are held by Baby Boomers and the remaining members of the Silent Generation. These are individuals who accumulated wealth through home ownership, decades of investing, business building, or simply diligent financial habits.

This massive transfer of financial resources will reshape the financial identity of entire generations. It will influence markets, philanthropy, investment strategies, spending patterns, and cultural attitudes toward money. Yet receiving wealth is not the same as being prepared to manage it. That is why financial literacy and education matter more now than ever.

Below is a look at what the numbers suggest, how each generation will be affected, and why knowledge is the most important inheritance of all.

How Much Will Each Generation Receive

The projected inheritance breakdown shows that most of the assets being transferred will land primarily with Generation X and Millennials, followed by Generation Z. Baby Boomers appear lower on inheritance charts not because they are losing wealth, but because they are the ones distributing it.

Here are the current estimates for inheritance by heirs through 2048:

- Baby Boomers: approximately 6 trillion dollars

- Generation X: approximately 39 trillion dollars

- Millennials: approximately 46 trillion dollars

- Generation Z: approximately 15 trillion dollars

Older generations are also expected to direct trillions toward charitable causes, while the bulk will be passed on to heirs through wills, family gifting, investments, property, or trusts. Many who are transferring assets are also exploring what experts call giving while living. In other words, they are passing wealth forward now rather than waiting until their estate is settled.

Regardless of timing, the numbers tell one story very clearly: a tidal wave of wealth is about to arrive in the hands of younger generations. The decisions they make with it will shape not only their own lives, but their families and communities for decades.

Baby Boomers and the Silent Generation

The Givers, the Legacy Builders, and the Architects of Generational Impact

The oldest generations hold the greatest concentration of wealth in history. For them, this moment is not just about finances. It is about legacy.

They spent decades building their portfolios and managing their resources. Many bought homes while prices were still accessible. They lived through interest rate cycles, recessions, bull runs, and major shifts in the market. Some built businesses. Others invested consistently for decades. And through this steady effort, they accumulated assets that will soon move to heirs.

Now they face the question of what will remain and how much of it will serve future generations well. This includes not only completing the paperwork, such as wills and trusts, but passing down values that have guided their financial lives. Open conversations about intentions, inheritances, taxes, investments, and charitable causes are essential parts of protecting family harmony and pointing heirs toward wise stewardship.

Managed well, this is not simply a transfer of wealth. It is a transfer of wisdom.

Generation X

The First Wave of Heirs and the Most Immediate Beneficiaries

Generation X will be the first to receive large-scale inheritances in the near term. Analysts note that they are positioned to inherit more than any other generation over the next two decades. Gen Xers are typically mid career, raising children, planning retirement, and balancing aging parents. They often carry both responsibility upward and downward within the family structure.

This makes the wealth transfer a moment of both opportunity and obligation.

With significant resources arriving, Gen X could:

- Play catch up on retirement savings

- Help children with higher education

- Pay off long term debt

- Invest in businesses

- Acquire real estate

- Support causes that matter to them

However, the influx of wealth can also bring pressure. Should they invest aggressively, reduce risk, or focus first on financial security. Should they hold assets or restructure them. Should they continue the strategies of their parents or pivot toward different financial tools.

The correct approach will vary by household. What matters most is that Gen X engages these decisions equipped with financial literacy. Without a basic foundation in investing principles, tax strategy, diversification, or long term financial planning, the gift they inherit could be mishandled or even lost.

This generation has the opportunity to use inherited wealth to build stability and confidence for themselves and for those who follow. But this can only happen with education, planning, and wise counsel.

Millennials

The Generation Most Likely to Redefine Wealth

Millennials are projected to receive the largest inheritance pool overall, with estimates reaching into the mid 40 trillion dollar range. This comes after a generation that has often faced steeper financial headwinds than their parents. Rising housing costs, educational expenses, wage compression, and high inflation have affected their progress and delayed milestones such as home ownership or retirement planning.

For that reason, the transfer of wealth could represent a historic turning point.

Analysts show that younger investors are more likely than Boomers to explore non traditional investment categories. These include private market investments, impact driven portfolios, and digital assets. They are also more likely to want their financial decisions to reflect personal values such as sustainability, social responsibility, or long term community impact.

For Millennials, inherited wealth may be used to:

- Pay down student or consumer debt

- Purchase homes that have been out of reach

- Launch or scale entrepreneurial ideas

- Invest for long term growth

- Support nonprofit efforts

- Build portfolios that align with personal convictions

It is an opportunity to rewrite future paths. But it also brings a temptation to overspend, upgrade lifestyle too quickly, or underestimate the long term responsibilities that come with managing significant wealth.

Financial literacy empowers Millennials to build solid foundations, invest intentionally, and convert inheritance into security rather than stress.

Generation Z

The Youngest Beneficiaries and the Long Term Stewards

Generation Z may be youngest in the lineup, but they are not absent from the conversation. Projections suggest they will inherit trillions over time. For many of them, wealth will arrive when they are still early in life, perhaps before full careers are established or before they have built financial habits strong enough to handle a windfall.

Inheritance without education is rarely a blessing. At its worst, it can be destabilizing.

That is why financial literacy for this generation is not optional. It is the foundation that enables them to become responsible stewards of resources that arrive earlier than expected. Learning concepts like compound growth, diversification, inflation, tax treatment, long term strategy, retirement planning, and financial risk becomes essential.

If Gen Z prepares wisely, the resources they steward could compound for decades, multiply opportunity, and expand legacy far into the future.

Why Financial Literacy Matters for Every Generation

Many families believe that inherited wealth automatically creates stability. History shows the opposite. Without education and grounded decision making, inherited wealth evaporates quickly. Family conflict often follows when expectations and intentions are not discussed openly.

Financial literacy protects inheritance in several ways:

It prevents waste. Windfalls are often mishandled without planning. Education provides discipline, clarity, and long term vision.

It reduces conflict. When families have transparent conversations, there is less confusion, less resentment, and more unity.

It multiplies resources. Knowledge allows each generation to grow what they have rather than simply receive it.

It strengthens the economy. Where financial knowledge rises, smart investing tends to follow. New businesses are started, charitable giving increases, and capital flows into ideas that solve problems.

It ensures values stay intact. Money is a tool. The way it is used reflects beliefs and priorities. Financial education helps future generations shape a story that is bigger than a bank account.

What Each Generation Should Begin Doing Now

Older Generations

- Clarify inheritance goals

- Build estate plans

- Communicate openly with heirs

- Consider early gifting where beneficial

- Pass down education and values, not only resources

Generation X

- Revisit financial plans

- Prepare for responsibility, not entitlement

- Learn tax strategy for inherited assets

- Diversify and guard against emotional investing

Millennials

- Use wealth as a launchpad for long term growth

- Shore up financial foundations before upgrading lifestyle

- Align investing with values without abandoning discipline

- Seek trustworthy guidance

Generation Z

- Begin learning now

- Build habits before wealth arrives

- View inheritance as stewardship

- Think long term rather than short term

A Final Thought

This wealth transfer is not just about economics. It is about identity, values, character, and legacy. Generations will shape the future with the decisions they make once the assets arrive.

Some will multiply what they receive. Some will consume it. Some will invest it in innovation, education, and impact. Others may struggle or squander opportunity.

The difference is not income level, inheritance size, or market timing. The difference is literacy. The difference is education. The difference is understanding how money works.

In a moment that has the potential to reshape thousands of futures, generations can respond with wisdom, clarity, and vision. They can use wealth as a tool, not a crutch. They can build stronger families, stronger communities, and stronger foundations for those who will come after.

The transfer is coming. And it will be transformative. Now is the time to prepare minds as well as portfolios.

Financial literacy is the key that unlocks the true value of this historic moment.

Black Friday vs. Best Friday

How to Turn a Shopping Day Into a Wealth-Building Mindset

Every November, millions of people wake up early, coffee in hand, ready to chase “once-in-a-lifetime” deals. It’s called Black Friday, the day retailers celebrate, banks quietly profit from, and consumers convince themselves they’re “saving money.”

But what if the best deal of the year isn’t a discount at all?

What if it’s a decision?

Welcome to Best Friday, the day you stop letting sales run your wallet and start letting knowledge run your life.

The Illusion of the “Deal”

Let’s start with what makes Black Friday powerful.

It’s not just the markdowns; it’s the marketing psychology.

Every flashing countdown, every “only 3 left,” every ad using words like exclusive and today only is designed to trigger scarcity. When our brains sense scarcity, logic goes quiet and emotion takes over.

Suddenly, spending feels like saving.

And that’s exactly the trap.

Last year, the average American planned to spend around $1,000 during the holiday season. The problem isn’t generosity; it’s unconsciousness. When spending replaces strategy, “limited-time offer” becomes another word for “long-term regret.”

What Really Happens on Black Friday

Here’s what’s often happening behind those glossy graphics:

- Retailers raise prices in October only to “slash” them later.

- Credit card companies profit twice — once from the swipe, again from the interest.

- Consumers mistake emotion for math. A 20% discount isn’t a bargain if you pay 22% interest over the next year.

It’s not evil; it’s engineered.

Black Friday isn’t about your needs; it’s about someone else’s bottom line.

Our approach doesn’t say “never spend.”

It is to spend with intention, and that’s how we turn Black Friday into your Best Friday.

What Makes It “Best”

Best Friday isn’t about skipping the season or feeling guilty for shopping.

It’s about directing the same excitement and energy toward choices that actually compound over time.

Think about it:

- What if you invested the amount you usually spend on “deals”?

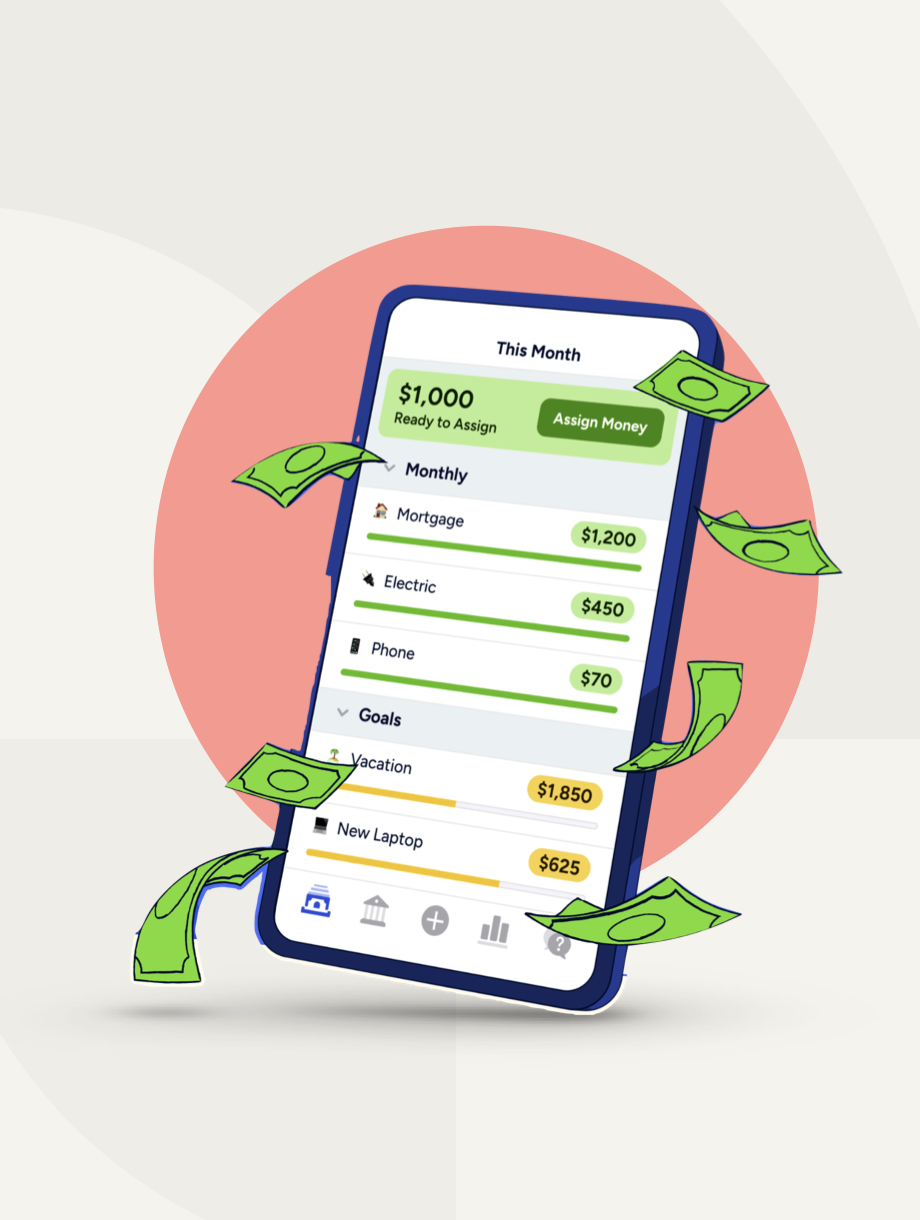

- What if you used the day to review your finances, set new goals, or automate savings?

- What if, for once, you bought something that appreciates instead of depreciates?

Best Friday is the mindset shift that says:

“I don’t need to spend to feel empowered. I can build instead.”

Example: The $800 Flip

Let’s say your holiday shopping list adds up to $800.

If you invested that money instead, say in a diversified index fund averaging 8% annual growth, and left it there for ten years, it would grow to $1,727.

Not bad for skipping a few impulse buys.

Now imagine you made that your Best Friday tradition. Every year, you invest the money you would have spent. After ten years, you’d have nearly $12,000 (and that’s without adding a penny from any other month).

Meanwhile, most of what’s bought on Black Friday loses value the moment it leaves the store.

The Emotional Side of Spending

It’s not just numbers; it’s neuroscience.

Shopping releases dopamine, the same “feel-good” chemical triggered by rewards and anticipation. That’s why it feels good to “add to cart.”

But dopamine spikes are short-term. What follows is often guilt, stress, or financial fatigue.

Best Friday teaches you to replace that temporary high with something sustainable:

- The confidence of seeing savings grow

- The relief of paying off debt

- The security of having a plan

Financial freedom has its own dopamine. It’s just quieter and lasts longer.

How to Turn This Year Into Your First Best Friday

You don’t need a perfect plan. You need a clear direction.

Here’s how to get started:

1. Redefine “reward.”

Instead of chasing discounts, reward yourself with progress.

Every dollar saved, invested, or redirected is a reward that multiplies.

2. Audit before you buy.

List what you actually need.

Ask, “Would I still buy this at full price?”

If not, it’s probably a want dressed as a need.

3. Build a “Best Friday” fund.

Move a small portion of your paycheck into savings or investment automatically each month. When November comes, your reward is waiting and growing.

4. Give intentionally.

Generosity is powerful, but planned giving is sustainable.

Budget for it. Make it part of your mission, not your reaction.

5. Take one financial literacy action.

Read one of our TheMoneyBooks

Take the Financial Literacy Quiz.

Meet with a financial educator.

Progress, not purchases, should define your Friday.

The Math of Meaning

When you understand compounding, you realize the smallest moves are the most powerful.

$100 saved and invested monthly for 10 years at 8% returns equals almost $19,000.

That’s not luck; it’s literacy.

And that’s what TheMoneyBooks philosophy is all about:

transforming the emotional energy of money into the logical confidence of strategy.

The Ripple Effect of Best Friday

Imagine if every family used one day in November not to buy but to build.

- Teens open their first savings accounts.

- Parents review insurance and emergency funds.

- Grandparents share how they’ve seen wealth grow or disappear.

- Friends challenge each other to invest, not impulse-shop.

It becomes a national reset button for financial habits, a moment of reflection that could transform not just one weekend but a lifetime.

Turning Awareness Into Action

Here’s the simple truth:

You can’t out-shop financial stress. You can only out-learn it.

Black Friday rewards spending.

Best Friday rewards understanding.

And the best part? You don’t need a sale to start. You just need a decision.

When you know how money really works, you stop chasing deals and start designing them. Your goals, your investments, and your future become the best bargains you’ll ever find.

A Challenge for This Year

Before you hit “checkout,” try this:

- Look at your total.

- Take half that amount and transfer it into your savings or investment account.

- Label it “Best Friday Fund.”

- Leave it there for one year.

Next November, open it again.

That quiet number growing on your screen?

That’s peace of mind, compounded.

The Bigger Picture

Black Friday was designed to measure consumer spending.

Best Friday could become the day we measure consumer understanding.

When families learn how money really works, they don’t just save dollars; they save decades of stress. They buy back their time, their options, and their confidence.

That’s the heart of TheMoneyBooks mission:

to turn every financial season into a learning season.

Because no discount compares to the return on knowledge.

Closing Thought

Black Friday may come once a year, but Best Friday can happen any time you decide it will.

Every time you choose purpose over pressure, planning over panic, and literacy over hype, you make it your Best Friday.

So this year, skip the rush.

Open your budget instead of your browser.

Learn something new about your money.

And give your future self the best gift of all: control.

Call to Action

Take your first Best Friday step today:

📘 Read one of our TheMoneyBooks

🧠 Take the Financial Literacy Quiz, and

💡 Contact a financial educator to learn how to make every dollar work for your goals, not against them.

Because when you understand money, every day has the potential to be your Best Friday.

Caught in the Middle

The Long-Term Care Squeeze No One Is Ready For

There’s a moment many adults never see coming. One day you’re raising kids, pushing toward career goals, maybe planning for your own retirement. And then suddenly you’re coordinating doctor visits for a parent, helping them with daily tasks, managing medications, or having conversations you never imagined having.

Welcome to the reality of the sandwich generation, a growing group squeezed on both sides, supporting children while caring for aging parents.

It’s emotional. It’s overwhelming. And it’s expensive.

But at the heart of this growing crisis is something most families don’t talk about early enough: long-term care.

The Love Is Real. The Cost Is Too.

The stories behind the statistics are deeply human. A daughter quits her job to bring her father home after a fall. A son burns through savings to cover in-home help for a mother with dementia. A family declines services because they simply “can’t afford the care Dad needs.”

This is playing out across the country.

According to recent caregiving surveys, more than half of family caregivers go into debt supporting aging loved ones. Many try to provide care themselves because professional options feel financially impossible. And yet the need for care doesn't disappear, it only grows.

These aren’t isolated stories. They’re the new normal.

Long-Term Care Isn’t Just a Medical Issue - It’s a Financial One

Long-term care isn’t about fixing a medical problem. It’s about helping a person live their daily life safely and with dignity. That includes:

- Home health aides

- Adult day programs

- Assisted living

- Memory care

- Nursing homes

- Respite care for family caregivers

And here’s the wake-up call: none of this is cheap.

A private room in a nursing home can exceed $100,000 a year. Assisted living often costs $50,000 or more. Even part-time in-home care can run thousands of dollars each month.

Most families simply aren’t prepared, emotionally or financially.

That's why so many adult children are forced to step in. Not necessarily because they planned to, but because long-term care was never discussed, never funded, and never put into the family financial plan.

“We Love Our Dad… But” The Stress No One Wants to Admit

Recent statistics highlights a painful truth caregivers often whisper but rarely say out loud:

“We love our dad. But we need to support our own families.”

Love doesn’t remove the financial pressure. And when families have no long-term-care plan in place, the burden falls on the next generation.

The result?

- Lost income

- Increased debt

- Delayed retirement

- Emotional exhaustion

- Family conflict

- Resentment no one wants to acknowledge

Caregivers often feel like they’re failing their parents and failing their kids, all at once. That’s the emotional math of long-term care when no plan exists.

Why Planning Early Changes Everything

Only 17% of adults have had meaningful conversations with parents about long-term care. That means 83% are waiting until a health crisis forces decisions that are rushed, expensive, and limited.

The lack of planning forces adult children to become the default long-term care strategy. But it doesn’t have to be that way.

A long-term care plan:

- Protects your parents’ dignity

- Protects your finances

- Protects your marriage

- Protects your children

- Protects your retirement

And most importantly, it protects the relationships that matter most.

The Shock Most Families Discover Too Late

People assume Medicare pays for long-term care.

It doesn’t.

Medicare covers medical recovery, not custodial care like bathing, eating, supervision, or dementia-related needs. And Medicaid? It only kicks in after you spend down assets to poverty levels, which forces families to sacrifice decades of savings.

Without a plan, long-term care becomes a crisis the family absorbs financially, logistically, and emotionally.

Sandwich Generation Math No One Talks About

Imagine this scenario:

- You’re putting two kids through school

- You’re saving for retirement

- You’re managing your own household

- You’re helping support aging parents

- And you’re paying out-of-pocket for care

Now add rising inflation, rising health-care costs, and the fact that people are living longer than previous generations.

That’s the squeeze.

And it’s why long-term care planning is no longer optional, it’s a necessity.

This Isn’t About Fear. It’s About Options.

Families without a long-term care strategy have:

- Fewer choices

- Less control

- Higher expenses

- More stress

- More guilt

- Greater financial risk

Families with a long-term care strategy have:

- A roadmap

- Predictable costs

- Protection for their savings

- Support systems in place

- Less stress and conflict

- Time to focus on being a family, not being caregivers

Planning doesn’t eliminate the challenges. But it changes the experience entirely.

So What Does a Long-Term Care Plan Actually Look Like?

It depends on the family, but generally includes:

1. Conversations about preferences

Where does your parent want care?

Home? Assisted living? Nursing support? Something hybrid?

2. An understanding of realistic costs

Many adults underestimate long-term care costs by over 50%.

Financial educators can help families map out real numbers, not guesses.

3. Insurance or asset-based long-term care strategies

Today’s long-term care planning tools can provide:

- Tax-advantaged benefits

- Flexible payout options

- Protection if care is never needed

- Coverage for home care or facility care

- Hybrid life-insurance-based solutions

4. A step-by-step affordability plan

For many families, creating a strategy is not about wealth, it’s about timing.

Smaller monthly premiums today prevent enormous costs later.

5. A financial professional guiding every step

Trying to navigate long-term care on your own is overwhelming.

Working with someone who understands the options gives families clarity and confidence.

Why a Financial Professional Matters More Than Ever

Families don’t fail at long-term care because they don’t care.

They fail because no one taught them what long-term care really means.

This is where a financial professional becomes invaluable.

They help you:

- Run the numbers

- Prepare for costs realistically

- Understand what insurance covers

- Compare policies

- Integrate long-term care with retirement planning

- Protect your children from inheriting the burden

- Create a strategy that makes sense for your situation

Financial literacy turns fear into preparedness and stress into strategy.

You Can Protect Yourself. You Can Protect Your Parents. You Can Protect Your Kids.

The sandwich generation often feels like they’re being crushed between two responsibilities. But with a long-term care plan in place, that pressure eases. Instead of reacting to emergencies, families move forward with clarity and calm.

Imagine:

- Not having to quit your job

- Not burning through savings

- Not arguing about who pays for what

- Not panicking during health decisions

- Not sacrificing your retirement to pay for care

That’s what planning makes possible.

The Future Belongs to Families Who Prepare

No one wants to burden their kids. No child wants to feel trapped by circumstances they never planned for. Long-term care is more predictable than people realize, but only if you plan for it early.

You can’t control aging. You can’t control health events. But you can control whether you face them unprepared or empowered.

This is the moment to start.

A WealthWave financial professional can walk you through the options, show you how long-term care integrates with your 7 Money Milestones, and help you create a strategy that protects everyone involved, including you.

Because long-term care isn’t just something older people need to think about one day.

It’s something families need to plan for today.

If you’re ready to protect your future and your family, it’s time to start the conversation.

Long Term Care: A Family Conversation Guide

5 Questions to Ask Before It’s Too Late

When it comes to money, everyone has blind spots. One of the biggest? Long-term care. Not because it’s complicated—though it can be—but because it requires something most people avoid: talking about the future, aging, and what happens when someone we love can’t fully care for themselves.

It's no wonder only 17% of people have even started planning for long-term care. That means most families are unprepared for the moment when decisions need to be made. And when the moment comes, it’s usually under stress, at a hospital, with emotions high and time short.

We believe in teaching people how money works—before they need it. Part of that is learning how to have “that talk” with the people you love most. So today, we’re breaking that silence with five clear questions every family should ask now—before it’s too late.

These questions won’t just help you create a plan. They’ll help you protect relationships, preserve dignity, and prepare emotionally and financially for what may be one of life’s most significant transitions.

But let’s start with the truth...

The Conversation Nobody Wants, But Everybody Needs

It’s hard to picture life when someone who once raised us, supported us, or stood beside us suddenly needs our help just to get through the basics: eating, bathing, moving, remembering.

It’s even harder to imagine what that might mean for our own family, savings, relationships, job—and future.

That’s why this conversation needs to happen way before life forces it. The sooner we have it, the more options, clarity, and peace we gain. That’s how we replace crisis with confidence.

So grab a notebook or open a shared doc. Pass around the coffee, not the awkward silence. And let’s walk through the five questions that can change everything.

Question 1: What Type of Care Would You Prefer, and Where?

Before dollars, policies, or logistics—start with dignity. What kind of life does your loved one want if they can’t live exactly the way they do now?

Ask:

- Do you want to stay at home as long as possible?

- If you needed daily help, would you prefer a professional caregiver or family?

- Would you ever consider assisted living or a memory care facility? Why or why not?

Each option has pros and cons.

- Home care offers familiarity and comfort, but it may require major upgrades—or a rotating team of caregivers.

- Assisted living provides structure and social interaction, but it can be expensive and emotionally challenging.

- Nursing care or skilled care is there when medical support is necessary, but it’s often a last resort.

This question grounds your planning in values, not money. It helps your loved one feel seen and respected. And it empowers you to make decisions with them—not for them—if the time comes.

Question 2: How Will We Pay for It?

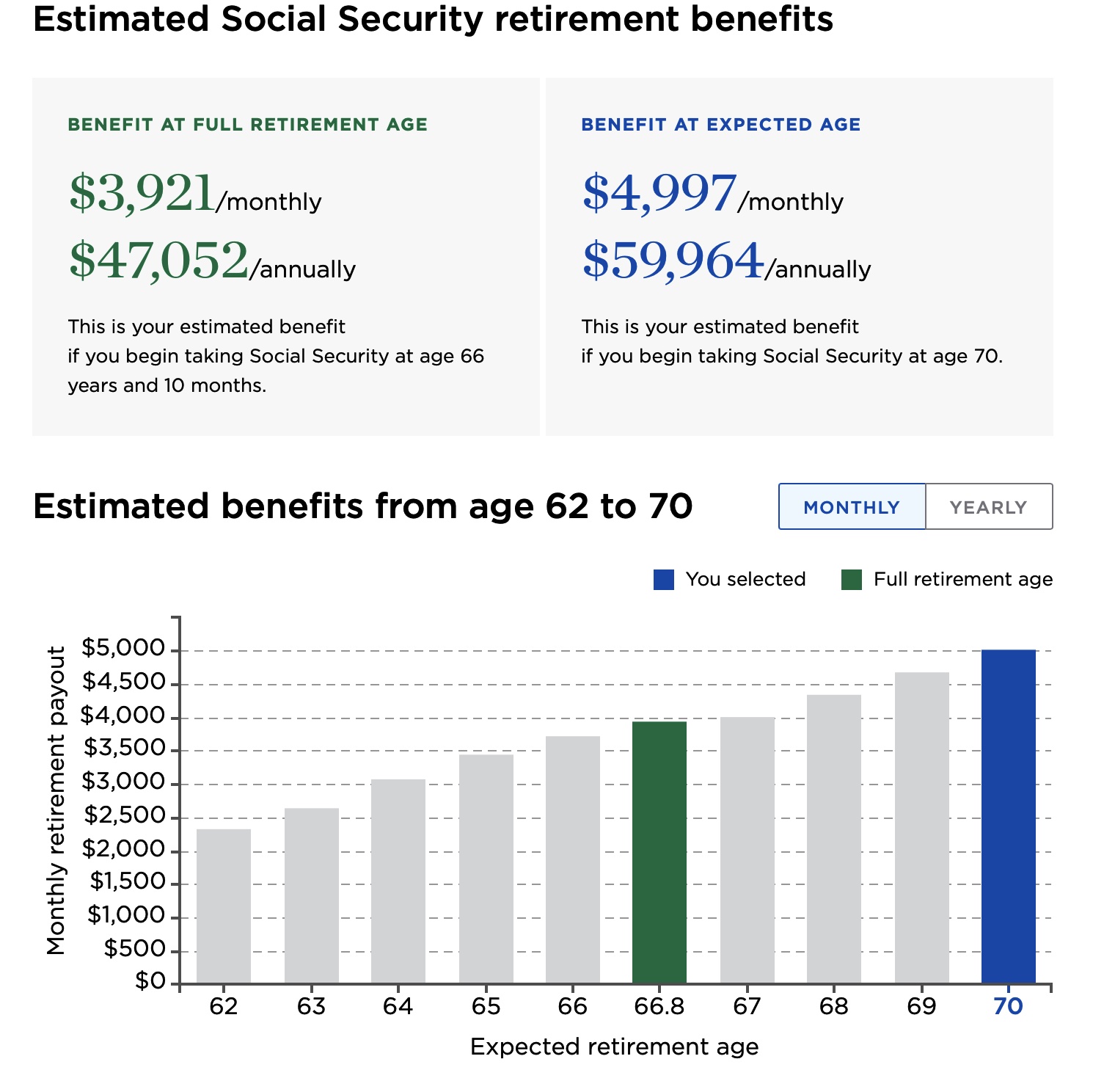

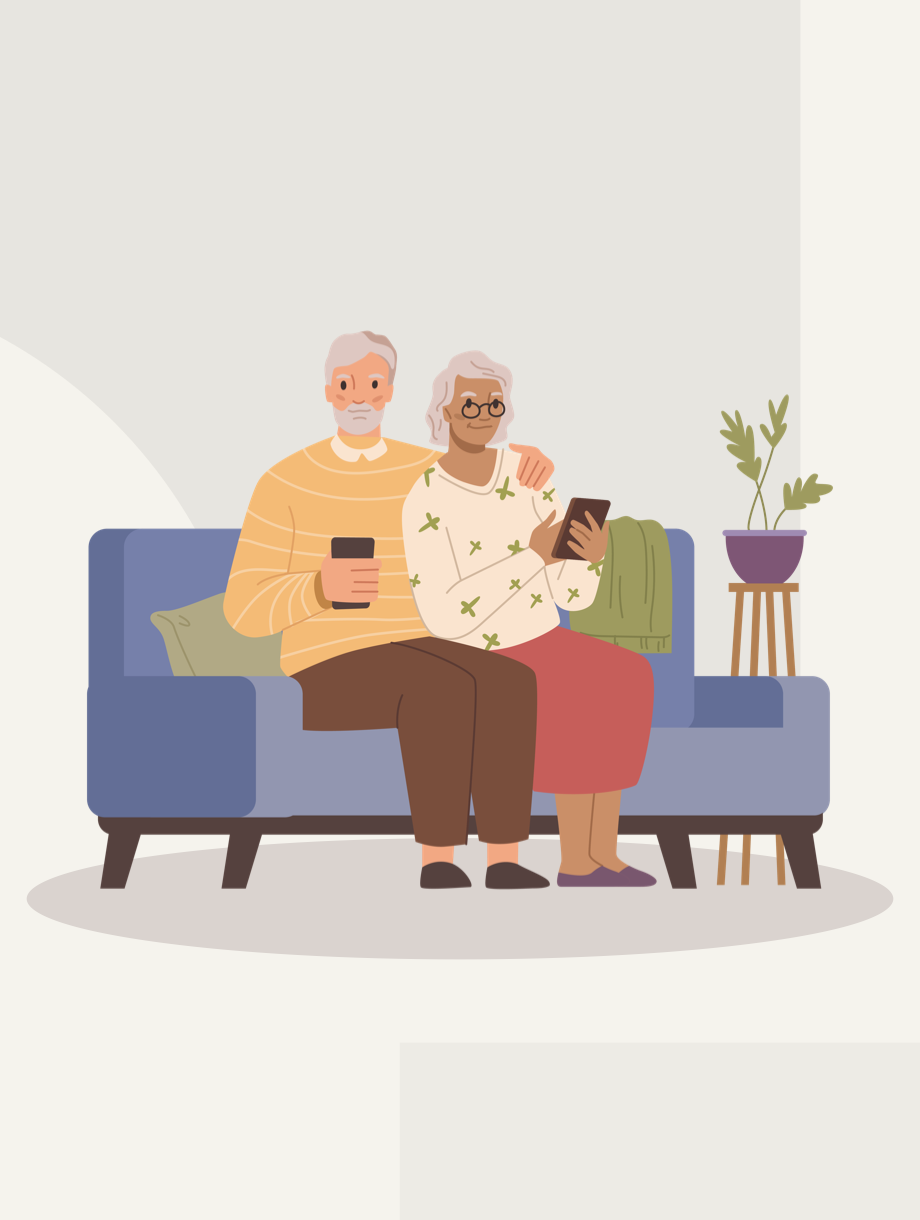

This is where money steps in as a tool, not a tension. The average cost of long-term care in America is rising each year. As of 2024, the numbers look like this:

- Home health aide (full-time): ~$68,000/year

- Assisted living facility: ~$54,000/year

- Private room in nursing home: ~$108,000/year

And remember: 20% of people age 65+ will need care for longer than five years.

So how do you prepare? By breaking down the options:

1. Savings and Assets – Retirement accounts, pensions, IRAs, property sales.

2. Insurance – Long-term care insurance or hybrid life/long-term care policies.

3. Government Programs – Medicaid (needs qualification), VA benefits, limited Medicare support.

4. Family Contributions – Often the least discussed and most stressful option unless planned ahead of time.

Talk openly. Ask:

- Do you already have long-term care insurance or a policy with a care rider?

- Are you counting on using home equity or savings?

- What income sources will be available in retirement?

This isn’t about prying—it’s about clarity. The biggest financial disasters come from silence, not shortfalls.

Question 3: What Documents Do We Need—and Where Are They?

Every financial educator has seen it: families scrambling through drawers, folders, and email accounts trying to find a power of attorney or trust document after a crisis hits.

Avoid that chaos.

Create a list of essential documents and make sure they’re updated and accessible:

🗂️ Legal Documents

- Power of Attorney (financial)

- Power of Attorney (healthcare / medical proxy)

- Living will / advance directive

- Last will and testament

- Trust documents (if any)

- POLST (Physician Orders for Life-Sustaining Treatment)

💳 Financial & Insurance Records

- Bank and retirement account details

- Long-term care insurance policies

- Life insurance policies

- Deed or mortgage statements

- Pre-paid funeral or burial plans

🔑 Where They’re Stored

- Physical copies: folder, safe, binder, lockbox

- Digital copies: encrypted folder, cloud storage, shared drive

- Password access: write it down or use a password manager

This isn’t paperwork. It’s protection. It’s your emergency instruction manual.

Question 4: Who Will Be Responsible for What?

One of the most painful moments in caregiving is when the weight falls on one person simply because they’re the closest, most available, or most emotionally involved.

That’s why a smart family assigns roles—not burdens.

Have an honest, practical conversation:

- Who lives closest? Who’s willing and able to help in-person?

- Who can manage finances, bills, and insurance?

- Who can provide emotional support or stay in touch with doctors?

- Who will be the medical decision-maker if needed?

Assigning roles now prevents resentment later. And it helps each person operate out of strength—not obligation.

You may even decide to form a "care team"—a shared system of regular check-ins and responsibilities. No family should handle long-term care alone. But no one should be surprised by it, either.

Question 5: What’s Most Important to You—Even If Circumstances Change?

This is the most powerful question because it goes deeper than logistics.

It’s not just “Where do you want to live?” It’s:

- What makes life worth living for you?

- What would you want to keep doing, no matter what?

- What would you not want us to do, even if we think it’s “best”?

This is where you discover the core:

"I want fresh air every day."

"I don’t want to live where I can’t see my grandkids."

"Don’t put me on machines if I’m not coming back."

"I’m okay downsizing—but I want my books, my garden, and my music."

These things matter. And when emotions rise or medical staff start asking hard questions, these answers give you a compass.

This is how you honor someone long after they’re able to explain themselves.

Bringing It All Together: Start the Conversation This Week

You don’t need to have every answer today, but you do need to ask the questions. Silence is the enemy of preparedness.

And here’s the surprising truth:

Most people are relieved when someone starts the conversation. They’ve often been thinking about it, worrying about it, or avoiding it quietly. You’re not bringing up something new—you’re bringing it into the light.

Your Action Plan

✅ Step 1: Schedule the Talk

Choose a calm day, a familiar place, and give everyone a heads-up.

✅ Step 2: Use the 5 Questions

Print them, write them, speak them—but stick to them.

✅ Step 3: Listen First

Don’t correct or judge—just capture everything.

✅ Step 4: Follow Up

Make a checklist: documents to gather, roles to assign, funding gaps to explore.

✅ Step 5: Bring in a Pro

This is the point where you should speak with a qualified financial professional—someone who can provide policy reviews, cost projections, benefit breakdowns, and planning strategies tailored to your situation.

Because the worst thing we can do is wait.

Before You Go: One Simple Truth

Planning for long-term care isn’t morbid. It’s loving. It says: “I don’t want my pain or vulnerability to become your crisis or confusion.”

It’s an act of stewardship, strength, and clarity.

This is how we protect families. This is how we preserve relationships under pressure. This is how we change the financial culture—one conversation at a time.

And the best part?

Now that you know what to do, you can help others do it too.

Let’s start the talk. Let’s protect the people we love. Let’s teach it forward.

Money Monsters: 7 Habits That Eat Your Budget Alive

How to Spot, and Stop, the Financial Creatures Hiding in Plain Sight

They lurk quietly.

In your bank app.

In your Amazon cart.

In that “small” subscription you forgot to cancel six months ago.

They’re the Money Monsters, habits that seem harmless day-to-day but quietly feast on your financial future.

Most people don’t lose control of their money because of one big mistake. It’s usually a series of small leaks: automatic withdrawals, thoughtless swipes, emotional splurges—that nibble at every paycheck until your budget looks like Swiss cheese.

The good news? You can trap these monsters once you learn to recognize their footprints.

Let’s shine a flashlight on the seven most common ones.

1. The Subscription Slime

It starts innocent enough:

“Only $9.99 a month.”

Then there’s another. And another.

Music, streaming, fitness, cloud storage, photo editing, meditation, pet food delivery, and the “free trial” you forgot to end. One by one, they blend into your bank statement until you’ve built a small financial ecosystem feeding on your income.

According to studies, the average person underestimates their monthly subscriptions by more than 70%. What you think is $40 often ends up being $110 or more.

How to fight it:

- Audit quarterly. List every recurring charge and ask, “Would I sign up for this today?”

- Cancel before you decide. If you miss it after a week, resubscribe. Most people never do.

- Bundle intentionally. Some services offer shared plans—just make sure you’re splitting costs fairly.

Subscriptions aren’t the enemy. Forgetting about them is.

2. The Latte Leech

We’re not here to shame coffee drinkers. This monster isn’t about caffeine—it’s about autopilot.

A daily $6 stop for coffee feels tiny. Yet over a year, that adds up to $1,500–$2,000. If you’re also grabbing lunch out three times a week, you could be draining another $2,500 annually.

That’s a plane ticket, an emergency fund, or two months of retirement contributions disappearing into foam and convenience.

How to fight it:

- Track one “small” habit for a month. You’ll likely gasp.

- Choose your ritual days (Fridays only, for example).

- Redirect the savings automatically. Brew at home → transfer $6 to savings. Small moves compound.

Your coffee isn’t evil—but unexamined habits are.

3. The Debt Goblin

This creature feeds on one emotion: avoidance.

You stop checking balances because they stress you out. You make minimum payments hoping it’ll all sort itself out later. Meanwhile, interest multiplies quietly in the dark.

A $5,000 credit card balance at 22% interest—making only minimum payments—can take 20 years to pay off and cost nearly $11,000 in total. That’s the Debt Goblin’s favorite meal: your future freedom.

How to fight it:

- Face the numbers. Write every debt, balance, interest rate, and payment.

- Choose your weapon:

- Snowball: Pay smallest balance first to gain momentum.

- Avalanche: Pay highest interest first to save money long-term.

- Call your creditors. Ask about hardship programs or rate reductions—you’ll be surprised how often they help.

The Debt Goblin thrives on silence. Once you face it, it loses power.

4. The Lifestyle Werewolf

This one hides under the full moon of success. You get a raise, and suddenly your spending rises with it. New clothes. Nicer dinners. A “deserved” upgrade.

It’s not greed—it’s human nature. Psychologists call it hedonic adaptation: our baseline for “enough” keeps shifting upward.

Here’s the problem: when lifestyle rises as fast as income, wealth never grows. You’re working harder, earning more, and still feeling behind.

How to fight it:

- Lock in your savings rate. If your income jumps 10%, increase savings or investing by 5%.

- Delay upgrades 90 days. If you still want it after the wait, it’s likely a genuine improvement, not a dopamine hit.

- Define “enough.” Write down what a good life actually looks like for you. Otherwise, you’ll keep chasing someone else’s version.

You can’t out-earn the Lifestyle Werewolf—you can only outsmart it.

5. The Impulse Imp

This sneaky creature loves checkout screens and “limited time” banners. It thrives on emotion: boredom, stress, or celebration.

It’s not just the big splurges—studies show most people make three unplanned purchases per week. Those micro-decisions, often under $50, add up to thousands annually.

How to fight it:

- Use the 24-hour rule. Want something? Screenshot it. Wait a day. Most desires fade with time.

- Shop from a list only. Whether online or in-store, anchor your actions to a plan.

- Block the bait. Unsubscribe from marketing emails and turn off push notifications.

Impulse buying isn’t about weakness—it’s about environment. Control that, and you control the Imp.

6. The Budget Phantom

This one is tricky because it looks responsible. You tell yourself you have a budget—maybe even a spreadsheet somewhere—but you never actually track spending in real time.

That’s how the Budget Phantom wins: by hiding reality behind rough guesses.

A Gallup poll once found that only 32% of households have an active, written budget. The rest are flying blind—and shocked when their card declines.

How to fight it:

- Automate your awareness. Use free tools that categorize spending automatically.

- Budget by buckets. Keep it simple: Needs (50%), Wants (30%), Future (20%).

- Schedule a weekly 10-minute check-in. Look at one number: “How much left in each category?”

Budgets aren’t about restriction. They’re about permission—to spend confidently within limits you’ve chosen.

7. The Comparison Kraken

No monster drains happiness faster.

You see a friend’s trip to Italy or a neighbor’s new SUV and think, “I’m behind.” Suddenly, your perfectly fine life feels inadequate.

Comparison fuels overspending. You justify upgrades not because you need them, but because you want to feel equal. That emotion—envy dressed as motivation—is expensive.

How to fight it:

- Recognize social media for what it is: highlights, not reality.

- Unfollow triggers. Protect your peace like you protect your wallet.

- Track your progress, not theirs. A personal net-worth chart or savings goal tracker makes your own wins visible.

Financial confidence doesn’t come from status—it comes from direction. If you’re moving forward, you’re doing better than you think.

The Monster-Proof Plan

Spotting the creatures is step one. Caging them takes consistent, simple actions—no silver bullets required.

- Name your top three monsters. Which habits feel most familiar? Awareness beats shame.

- Attack one at a time. Small, focused wins stick longer than total overhauls.

- Create automatic systems. Auto-transfers to savings, auto-debt payments, auto-investing. Automation is garlic for financial vampires.

- Use accountability. A financial educator, friend, or partner keeps you honest and encouraged.

- Replace, don’t remove. Cut the bad habit, but fill the gap—brew coffee with friends, plan a “no-spend Saturday,” or turn budgeting into a challenge game.

You can’t just eliminate habits; you must rewrite them.

The Transformation: From Fear to Freedom

In TheMoneyBooks, we often say financial literacy isn’t about perfection—it’s about direction. Once you start learning how money really works, the monsters shrink fast.

Think about what each of these habits costs—not just in dollars, but in stress and missed opportunities:

- The Subscription Slime steals awareness.

- The Latte Leech steals momentum.

- The Debt Goblin steals freedom.

- The Lifestyle Werewolf steals contentment.

- The Impulse Imp steals purpose.

- The Budget Phantom steals clarity.

- The Comparison Kraken steals joy.

Add those up, and you see why so many families feel stuck no matter how much they earn. But add up the opposite traits—awareness, momentum, freedom, contentment, purpose, clarity, joy—and you get wealth, in every sense.

A Final Word

There’s a reason our mission begins with education. Once you understand how these monsters operate, you can’t unsee them—and that’s a good thing. Awareness is permanent protection.

This week, choose one. Just one.

Shine a light on it.

Measure its cost.

Make one small change.

Maybe that’s canceling an unused subscription. Maybe it’s deleting a shopping app. Maybe it’s opening your first investment account instead of another store card.

Whatever it is, it’s a step toward your Best Friday, your Debt-Free December, your Financially Free Future.

When you win one battle, momentum builds. When you win all seven, your money finally works for you—and not the monsters.

Ready to see where you stand?

Take the Financial Literacy Quiz and find out which habits are hiding in your financial life. Then get one of our TheMoneyBooks and connect with a financial educator to arm yourself with the knowledge to keep every dollar working toward your goals.

Because the only thing scarier than Money Monsters…

is pretending they’re not there.

Why Every Family Needs a Plan

Estate Planning: A Simple Guide for Every Family

Estate planning isn’t just for the wealthy or the retired. It is a basic life plan that organizes what you own and what you want so your family can act with clarity during tough moments. Think of it as future-proofing your wishes, your kids’ care, and your medical decisions.

Below is a general, plain-English guide to help you and your family get started.

A quick reminder this is not legal advice. If you want help personalizing any of this, speak with a qualified financial professional who can coordinate with your legal and tax advisors.

What Estate Planning Really Covers

At its core, an estate plan answers three big questions:

- Who gets what? You decide how your assets should be distributed.

- Who cares for your children? You can legally name guardians for minors.

- Who speaks for you in a medical crisis? You can record your health care wishes and appoint decision-makers if you cannot decide for yourself.

With a plan, you keep control over these decisions. Without one, state rules and the court process have a larger say.

Why So Many Families Plan Around Probate

Probate is the court-supervised process for paying debts and distributing assets after someone dies. It can take time, add costs, and make details public, which is why many people try to avoid it when they can.

A revocable living trust is often used to help assets pass outside probate when it is properly set up and funded. This can make distribution faster and more private for your beneficiaries.

General guidance: A financial professional can help you understand whether probate is likely for your situation, and how titling, beneficiary designations, and trusts could change the outcome for your family.

If You Have Children, Start Here

Guardian designations are one of the most important parts of a plan for parents of minors. If you do not name guardians, a court may need to decide who steps in. Naming primary and backup guardians puts you in charge of that decision and reduces uncertainty for your kids.

Helpful idea: Write a short “parenting letter” that shares values, routines, and preferences. Store it with your documents so guardians understand the heart behind your instructions.

The Health Care Side Most People Forget

Estate planning also covers your medical voice:

- Health care surrogate or proxy: The trusted person who can make treatment decisions if you cannot.

- Living will or advance directive: Your preferences for life support and end-of-life care.

- HIPAA authorization: Permission for your chosen people to access medical information so care is not delayed.

Clear documents spare your family from guesswork during emergencies.

The “Starter Toolkit” Most Households Use

A comprehensive, trust-based set of documents typically includes:

- Revocable Living Trust

- Last Will & Testament

- Financial Power of Attorney

- Health Care Surrogate/Medical POA

- Living Will/Advance Directive

- HIPAA Authorization

- Personal Property Memorandum

- Assignment of Personal Property

- Pet Trust (if you have animals that need care)

General guidance: A financial professional can help you coordinate these documents with how your accounts and policies are titled, so the paperwork and the real-world assets match.

Common Mistakes To Avoid

1) Waiting “until later.” Emergencies do not check your calendar. Begin with simple steps you can finish this week.

2) Creating a trust but not funding it. A trust only works for assets that are titled to it or directed to it through beneficiary designations. Ask for a funding checklist and go account by account. (Your legal documents and your account records should tell the same story.)

3) Skipping guardians. Name primary and backup guardians for minor children and let them know you have chosen them.

4) Forgetting medical directives. Financial instructions are only half the plan. Add your health care surrogate, living will, and HIPAA authorization.

5) Hiding documents. Store originals safely. Share copies or secure digital access with the people who will need them.

6) Never reviewing. Revisit your plan after major life changes such as marriage, divorce, the birth or adoption of a child, a move to a new state, or starting a business. A periodic review helps keep your plan aligned with your life.

A 7-Day “Action” Plan

Use this week to get traction. Tackle one step each day and you will be further along than most households.

Day 1 — Inventory

List your accounts, real estate, insurance, business interests, and debts. Note titling and beneficiaries.

Day 2 — People

Choose a successor trustee, financial and medical agents, and guardians. Confirm they are willing. Pick backups.

Day 3 — Health

Complete your health care surrogate, living will, and HIPAA authorization. Share copies with your agents.

Day 4 — Build

Create your revocable living trust and will. Keep your instructions clear and values-driven.

Day 5 — Fund

Retitle assets where appropriate and update beneficiary designations. Use an assignment of personal property and a personal property memorandum for household items and keepsakes.

Day 6 — Guardian pack

Write your parenting letter. Add school, medical, and routine details. Tell guardians where documents are kept.

Day 7 — Share and store

Give key people copies or secure digital access. Store originals safely. Put a reminder on your calendar to review in 12 months.

General guidance: If your week is packed, ask a financial professional to help you batch these steps into one or two working sessions.

Will vs. Trust: A Simple Way to Think About It

A will is valuable for naming guardians and directing distributions, but it usually needs probate before assets move. A revocable living trust, when properly funded, is commonly used to streamline transfers and increase privacy for your family. Many people use both: a will that coordinates with a trust.

Your situation may differ based on your state, the types of accounts you hold, and your goals for timing and privacy. This is where a conversation with a financial professional pays off.

Keep It Practical

- Start simple. Do the next right step, not everything at once.

- Match paperwork to accounts. Titles and beneficiaries should reflect your written wishes.

- Make it findable. Your plan should be easy for loved ones to locate and follow.

- Review as life changes. Update after major events or at regular intervals.

A Gentle Nudge To Act

Estate planning is a kindness to your future self and to the people you love. It turns anxiety into order, and public court processes into private family transitions. This week, pick one step and complete it. Then keep going.

If you want help translating this guide into a plan that fits your life, contact a qualified financial professional. They can coordinate your plan across documents, account titling, beneficiary choices, insurance, and storage, and bring in legal and tax experts where needed. That support can save time, reduce stress, and help your plan work the way you intend.

The financial nightmare of domestic violence

October is Domestic Violence Awareness Month. Many people think of bruises or broken bones, but there’s another weapon of abuse that leaves scars you can’t see on the outside: financial abuse.

Experts estimate that more than 10 million adults experience domestic violence, and almost 100% also experience financial abuse. Sadly, we rarely talk about it because its effects aren’t always visible, but it is just as devastating.

Economic abuse usually takes the form of control, sabotage or exploitation. Abusers may drain bank accounts, hide assets, deny or limit access to money, demand a detailed accounting of every dollar spent or criticize financial decisions until the victim doubts herself. It can also mean threatening to withhold money, forcing the victim to miss or be late to work, belittling her accomplishments or even physically preventing her from going to work or school. Abusers will also run up debt in their victim’s name, ruining her credit score and leaving her with little to no access to financial resources.

The end result is the same: dependency. When you don’t have money of your own, when your credit is destroyed and when you’ve lost jobs because of abuse, you’re trapped. The financial chains can feel as strong as physical ones.

The costs ripple far beyond individual households. Consider these staggering facts:

• Research shows that survivors of intimate partner violence lose 8 million days of paid work every year.

• More than half of survivors lose a job due to abuse, and about 70% report being blocked from working at all.

• Nearly 60% of victims suffer harm to their credit by their abuser.

• The overall workplace productivity costs are $1.3 trillion.

These aren’t just personal tragedies. They’re economic crises. Every lost job, every ruined credit score, every foreclosure or eviction caused by abuse strains our communities, our workplaces and our economy. Employers lose talent, banks absorb defaults, and taxpayers foot the bill for social services and health care.

Why aren’t we more outraged? Why don’t we talk about financial abuse in the same breath as physical violence? Because it’s quieter. But it’s no less destructive.

Ending financial abuse has to become a priority if we’re serious about ending domestic violence. That means recognizing the warning signs both for potential victims and for those of us who can help. It also means systemic change.

Employers must understand that domestic violence is a workplace issue. Flexibility, support and resources can mean the difference between a survivor keeping or losing her job. Financial institutions should be trained to recognize red flags and provide confidential support for clients in crisis. Lawmakers should strengthen protections so survivors aren’t punished for debts forced on them by abusers, and so leaving doesn’t mean financial ruin. Starting over is difficult enough; starting behind seems an almost impossible hurdle.

Most important, we need to keep naming financial abuse for what it is: violence. Control over money is control over life itself. Stripping someone of their ability to earn, save or plan isn’t just bad behavior. It’s a calculated act to keep them powerless.

If October is a month of awareness, let’s be truly aware. Domestic violence doesn’t always show up as bruises. Sometimes it shows up as an empty bank account, a destroyed credit report or a career cut short. Until we end financial abuse, we will never fully end domestic violence.

If you’re a business leader, look at how your company can support employees who may be silently struggling. If you’re in finance, consider what policies or safeguards your institution could put in place. And if you’re a friend or family member, know the signs and know that asking, “Why doesn’t she just leave?” is the wrong question. The right question is, “How can we help her find the resources to rebuild her life and financial foundation?”

Economic independence leads to freedom. And freedom is what every survivor of domestic violence deserves.

— Kim Scouller

As published on triblive.com. https://triblive.com/opinion/kim-scouller-the-financial-nightmare-of-domestic-violence/

The Workplace Life Insurance Illusion

Why It’s Not Enough

When most people start a new job, they scan through the benefits package, sign a few forms, and feel reassured when they see life insurance listed as part of the deal. It feels like a built-in safety net — a box checked with no effort and no cost.

But here’s the uncomfortable truth: for most families, that workplace policy isn’t nearly enough.

According to the 2025 Facts About Life Insurance – Workplace Benefits report, the median basic coverage employers provide is either a flat $20,000 or just 1x salary. For a household that depends on two incomes, a mortgage, and future goals like college tuition or retirement, that number doesn’t stretch very far.

Yet more than half of workers (57%) believe their employer’s coverage is enough. That false sense of security is what we call the workplace life insurance illusion.

Why We Rely Too Much on Workplace Coverage

On the surface, workplace coverage seems convenient:

- You don’t have to shop around.

- You don’t have to fill out medical forms or go through underwriting.

- You don’t have to pay extra premiums (basic coverage is often free).

It’s a benefit that feels simple and automatic — and in a busy world, simplicity is attractive.

But simplicity can also be deceiving. That $20,000 payout might sound like a lot in the abstract, but when stacked against real expenses, it doesn’t go far. For many families, it wouldn’t cover even six months of mortgage payments, child care, or daily living costs.

Almost half of households (49%) that rely only on workplace life insurance admit their family would face financial hardship in less than six months if a wage earner died unexpectedly. That’s not long-term protection — that’s a ticking clock.

The Awareness Gap

Here’s the kicker: many workers don’t even realize what they have.

- 36% of U.S. workers are not fully aware they even have coverage through their employer.

- Only 29% of adults with workplace-only coverage say they’re very or extremely knowledgeable about life insurance.

This knowledge gap leaves families exposed in two ways:

- They overestimate the protection they have.

- They underestimate what they really need.

In TheMoneyBooks we teach: If it matters, measure it. Your financial future, your family’s security, and your legacy matter — which means you can’t leave them unmeasured, uncalculated, or unprotected.

What “Enough” Really Means

So how much life insurance do families actually need?

Experts typically recommend coverage equal to 10–15 times your annual income. That’s enough to cover:

- Final expenses (funeral/burial costs average $8,000–$12,000).

- Mortgage payoff or ongoing housing costs.

- Replacing lost income so surviving family members can maintain their lifestyle.

- Childcare, college tuition, or eldercare.

- Retirement savings support for a spouse.

When you compare that with $20,000 or 1x salary, it’s easy to see the gap. If you earn $60,000 a year, a workplace policy of $60,000 is just one year’s income — hardly enough to secure the next decade, let alone a lifetime.

Generational Realities

The illusion plays out differently across generations:

- Gen Z and Millennials often rely heavily on employer benefits, with 23–26% saying workplace life insurance meets their needs. They’re young, just starting their financial journeys, and may assume work coverage is enough “for now.”

- Gen X is most reliant, with 37% saying they depend completely or mostly on workplace life insurance. At the very stage when financial responsibilities are heaviest, they’re leaning on policies that don’t cover nearly enough.

- Baby Boomers are less reliant, but many are underinsured heading into retirement.

Across the board, reliance on employer coverage is a fragile strategy. Jobs change, employers downsize, and benefits shift. Your family’s protection shouldn’t depend on the HR department’s decisions.

The Hidden Risks of Workplace-Only Coverage

- It ends when your job ends.

If you leave your job — voluntarily or not — your coverage often disappears. That means if you switch careers, retire early, or get laid off, you may suddenly be uninsured. - It doesn’t grow with your needs.

Life events like marriage, children, or buying a home increase the amount of protection you need. Employer policies rarely adjust in proportion. - It may not be portable.

Some plans offer the option to convert workplace coverage into an individual policy, but the premiums can be much higher than if you had purchased coverage independently earlier in life. - It can create false peace of mind.

Believing you’re covered when you’re not leads to dangerous inaction. By the time many people realize the shortfall, health issues or age have made new coverage more expensive or unavailable.

Measuring Your Real Needs

The antidote to the workplace illusion is clarity. You don’t have to guess whether your employer’s coverage is enough. You can measure.

Ask yourself:

- How much would my family need to replace my income for 10–15 years?

- Do I want my mortgage paid off if something happens to me?

- Do I want to fund college education for my children?

- Do I want to leave money behind to care for aging parents or build a legacy?

Run those numbers through a simple life insurance needs calculator. (TheMoneyBooks offers one, as do most financial educators.) The gap between your needs and your employer’s policy will quickly become obvious.

The Role of Education

Education changes everything. Workers who understand how life insurance works, what it costs, and what it covers make better decisions.

Right now, myths dominate the conversation:

- “It’s too expensive.” (In reality, many young, healthy adults can get $500,000 of term coverage for less than $1 a day.)

- “I don’t need it until I have kids.” (By then, premiums may be higher, and health conditions may complicate approval.)

- “Work provides enough.” (The numbers prove otherwise.)

In the 2025 Barometer Study, only 29% of consumers overall believe they’re knowledgeable about life insurance. Education is the first step in closing that gap.

A Real-World Example

Imagine this scenario:

Jessica, a 38-year-old marketing professional, earns $80,000 a year. She has two kids, ages 6 and 9. Her employer provides life insurance equal to her salary — $80,000.

If Jessica passed away unexpectedly, her family’s expenses would not disappear. Her mortgage alone is $1,700 a month. Add in food, childcare, healthcare, and everyday bills, and her family spends nearly $5,000 a month.

Her employer’s life insurance payout would last them about 16 months — just over a year of survival. But what about the next 10 years of raising kids? What about college? What about her spouse’s retirement plan?

Jessica realizes she actually needs closer to $800,000–$1 million in coverage. Her employer’s policy covers just 10% of that need.

That’s the workplace life insurance illusion in action.

How to Protect Beyond Work

The good news: the solution is straightforward.

- Calculate your real need. Don’t guess. Use a calculator or work with a financial professional.

- Get your own policy. Term life insurance is affordable and flexible. Owning your own policy ensures protection follows you, not your job.

- Supplement, don’t replace. View workplace coverage as a supplement — a helpful add-on, not your only strategy.

- Review regularly. Needs change as life changes. Review coverage after major milestones like marriage, buying a home, or having children.

Why This Matters

Life insurance isn’t about numbers on a policy statement. It’s about the day your family faces the unthinkable. Will they have the resources to grieve without financial chaos? Will your children stay in the same home and schools? Will your spouse keep the retirement plan intact?

The illusion of workplace coverage is dangerous because it whispers, “You’re fine.” But fine isn’t enough.

In TheMoneyBooks, we repeat a principle that applies here: protect first, then grow. Growth without protection is like building a house without a foundation. One storm can wipe it out.

It's Time to Stop Being a Sucker®

The statistics are clear:

- Median workplace coverage = $20,000 or 1x salary.

- 57% of employees believe that’s enough.

- 49% of families relying on workplace coverage admit they’d struggle financially within six months of a wage earner’s death.

Those numbers add up to a nationwide illusion. The solution? Education, measurement, and taking control.

Your employer’s policy is a start, but it’s not the finish line. Protect your family with coverage that truly matches your needs — because if it matters, measure it.

Why Women Can’t Afford to Wait on Life Insurance

When it comes to financial security, women in America are standing on a fault line. For years, surveys have shown that women lag behind men in life insurance ownership. The latest 2025 Insurance Barometer Study confirms it: fewer than half of women (48%) say they have life insurance, compared with 54% of men.

That may sound like a small gap, but when you zoom in on the reality behind those numbers, it’s startling. Millions of women are one unexpected life event away from leaving their families exposed to debt, financial hardship, and broken dreams.

And here’s the most important part: it doesn’t have to be this way.

In our TheMoneyBooks series, we teach a core principle: protect first, then grow. Financial literacy is the bridge between worry and confidence, and nowhere is that more urgent than in the conversation about life insurance.

The Ownership Gap: More Than a Number

So why do fewer women own life insurance?

The data gives us a roadmap:

- Knowledge gap: Less than a quarter (23%) of women feel very knowledgeable about life insurance, and more than 1 in 10 say they know nothing at all.

- Cost misperception: Three-quarters of women overestimate the cost by 3–5 times the actual amount. Most admit they’re just guessing.

- Decision delay: Many say they haven’t “gotten around to it,” or that other financial priorities keep pushing it down the list.

- Complexity of underwriting: Over half (55%) say they don’t understand the process at all.

The result? A financial blind spot that affects not only women but their families, communities, and long-term wealth-building potential.

The Stakes Are Higher for Women

This gap isn’t just about percentages — it’s about lives. Women consistently report higher financial concerns than men:

- 42% worry about having enough for a comfortable retirement.

- 40% worry about saving for emergencies.

- 37% worry about long-term care needs.

- 35% worry about supporting themselves if illness or injury prevents them from working.

These are not small anxieties. They’re the real-life scenarios that derail families financially. Without protection in place, these risks become crises.

Nearly half of women (49%) believe their families would experience financial hardship within six months if the primary wage earner died unexpectedly. Three in ten say hardship would hit within just one month.

That’s not “someday” risk — that’s right now.

The Myths That Hold Women Back

Let’s confront three of the most damaging myths that keep women from getting covered.

Myth 1: “Life insurance is too expensive.”

In reality, a healthy 30-year-old woman can buy a 20-year, $500,000 term policy for the price of a daily latte. Yet, because of misinformation, most women believe it costs three to five times more than it really does.

Education flips this myth on its head. Once women see real quotes, the affordability becomes clear.

Myth 2: “I don’t have dependents, so I don’t need it.”

Life insurance isn’t just about children. It’s about anyone who relies on your income — a partner, aging parents, or even yourself if you want coverage for final expenses, debt payoff, long-term care options, or legacy giving. Waiting until you “need it” usually means paying more later or facing health-related challenges that limit your options.

Myth 3: “I’ll get around to it eventually.”

Time is not your friend here. The younger and healthier you are, the more affordable coverage is. Procrastination raises costs — and sometimes closes the window entirely if illness strikes before you’ve secured coverage.

Women’s Financial Power: Why Insurance Is Essential

Here’s the bigger picture: women are not just participants in the financial system. They’re becoming its leaders.

- Women control more than $10 trillion in U.S. financial assets, a number expected to triple in the next decade.

- Women make the majority of household purchasing decisions and are increasingly the breadwinners.

- Women are at the center of the Great Wealth Transfer, which will see trillions move across generations in the coming years.

With so much financial power, leaving the foundational step of protection undone undermines the very progress women have fought for. Life insurance isn’t a “nice-to-have.” It’s a critical part of building lasting wealth.

The Role of Financial Literacy

At TheMoneyBooks, we’ve seen firsthand how financial literacy changes this conversation. Once women understand:

- How life insurance works,

- Why it’s affordable, and

- How it protects their long-term goals,

the decision becomes easier.

Knowledge doesn’t just close the gender gap — it closes the confidence gap.

When women are informed, they move from being unsure and hesitant to decisive and empowered. That shift has ripple effects across their families and communities.

Shopping Smart: How Women Prefer to Buy

The study also highlights how women want to shop for coverage:

- 40% would research online but ultimately buy through an agent or financial professional.

- 26% would complete the purchase entirely online.

- 27% are actively looking for direction from a financial professional.

That tells us something important: women don’t just want products. They want guidance. They want someone who educates, listens, and helps them align protection with their goals.

This is where our mission fits perfectly. TheMoneyBooks series doesn’t sell policies — they build understanding. Once that foundation is laid, working with a financial professional becomes a natural next step, not a pressured sales pitch.

Stories That Inspire Action

Sometimes numbers aren’t enough. Stories bring the message home.

Consider the woman who thought life insurance would cost her hundreds of dollars a month. When she saw the actual quote — less than her family’s streaming bill — she cried with relief.

Or the mom who bought coverage after realizing her children would face financial hardship within weeks if anything happened to her. That single decision gave her peace of mind she hadn’t felt in years.

Or the single professional who purchased coverage to lock in affordable rates now, knowing she wants to start a family in the future. She called it “a gift to my future self.”

These aren’t isolated stories. They’re everyday women who realized waiting was the real risk.

The Urgency of Now

Here’s the truth: every month without coverage is a gamble. The longer you wait, the higher the cost, the fewer the options, and the greater the risk of being unprotected when your family needs it most.

Financial literacy gives women the power to:

- See the real cost — and recognize affordability.

- Understand the purpose — protecting loved ones, securing goals, building legacy.

- Take timely action — because tomorrow is never guaranteed.

This isn’t fear-based. It’s reality-based. Women who act now build a wall of protection that gives them the freedom to focus on growth, opportunity, and long-term wealth.

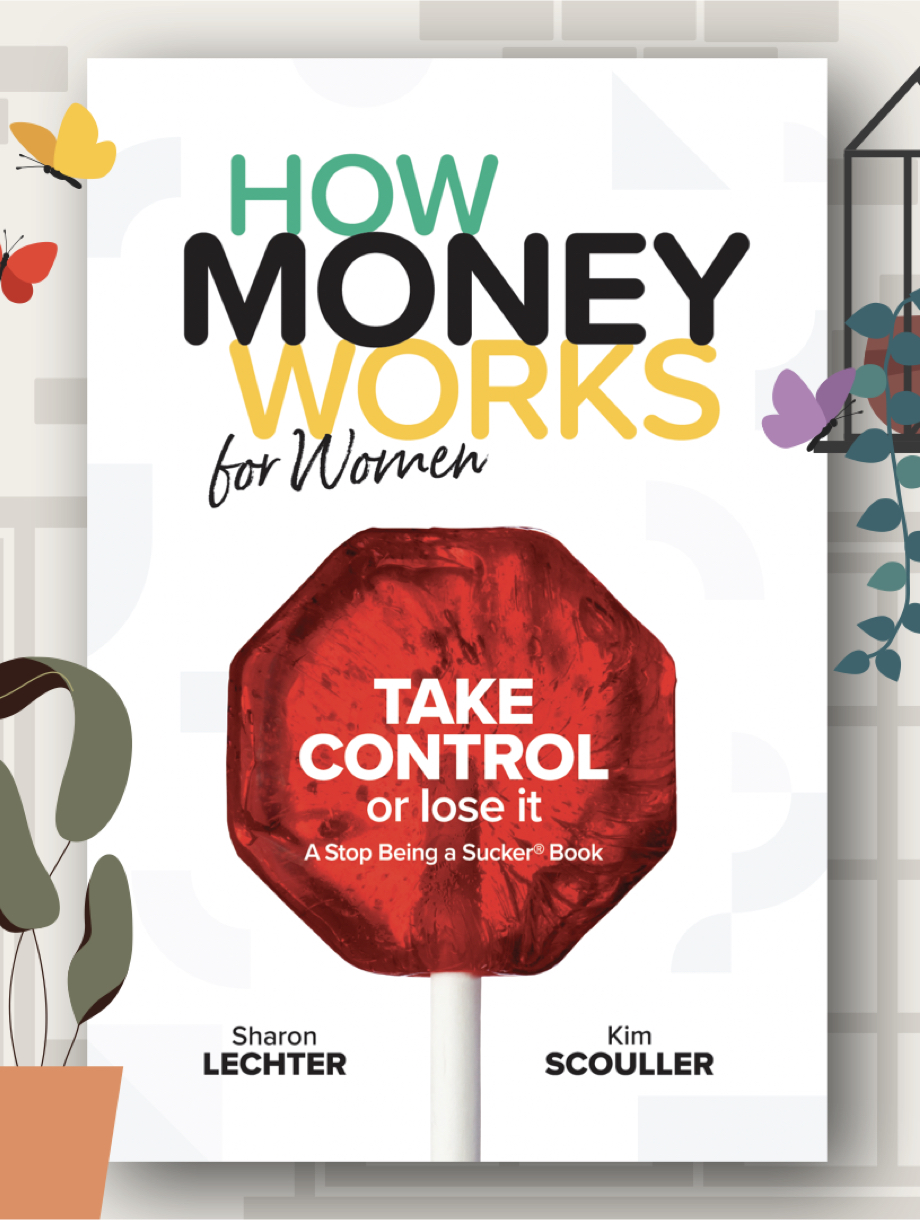

How TheMoneyBooks Can Help

HowMoneyWorks for Women: Take Control or Lose It was created for exactly this reason. It addresses the unique challenges women face, from longer lifespans to pay gaps to caregiving responsibilities. It offers practical, approachable education — not jargon, not intimidation.

The book doesn’t just tell women what to do. It shows them how to think differently, how to ask the right questions, and how to spot the myths that keep too many stuck.

When paired with a conversation with a trusted financial educator, it becomes a game-changer. It’s the difference between feeling exposed and feeling protected.

A Call to Action

The numbers from the 2025 Barometer Study are clear: women’s reported need for life insurance is high, but ownership lags behind. Millions are exposed. Millions are waiting.

But waiting is costly.

The path forward is simple:

- Get educated.

- See real numbers.

- Protect your family.

- Then focus on building wealth.

Life insurance isn’t the end of the story. It’s the foundation of the story you want to write.

Final Word

If you’re a woman reading this, the question isn’t “Do I need life insurance?” The question is “Can my family afford for me not to have it?”

The answer, for nearly everyone, is no.

Don’t wait. Start today. Your family — and your future self — will thank you.

From Financial Stress to Financial Freedom

The Weight You Can’t See

You feel it before you name it. That tightness in your chest when the credit card bill arrives. The restless nights wondering if your savings will last through retirement. The nervous glance at gas prices, grocery receipts, or your 401(k) balance when the market dips.

Financial stress doesn’t just live on spreadsheets. It shows up in our health, our relationships, and even the choices we make day to day. According to the 2025 Schroders US Retirement Survey, 65% of Americans say they worry about money too much — and more than half believe that financial stress is harming their health.

But here’s the truth: financial stress isn’t permanent. It’s a signal. And with the right plan, you can move from uncertainty to clarity, from constant worry to confidence — from financial stress to financial freedom.

Why Financial Stress Feels So Heavy

Money stress is unique because it’s both practical and emotional.

- It’s practical because you need money to meet life’s basics: housing, food, transportation, healthcare, and the occasional cup of coffee that makes the morning a little better.

- It’s emotional because money represents security, opportunity, and even identity. When it feels scarce or uncertain, it can make the future feel unpredictable — or worse, hopeless.

In the survey, 81% of retirement plan participants said they were at least slightly concerned about outliving their money. And 53% feared losing too much in a market downturn. These aren’t abstract worries — they’re rooted in a real gap between where people are and where they feel they need to be.

The average worker believes they’ll need $1.28 million to retire comfortably. Yet nearly half expect to have less than $500,000 — and one in four expect less than $250,000.

That gap is where stress lives.

Stress Has a Cost You Can Measure

Financial stress doesn’t just keep you up at night — it can cost you in ways you don’t always see.

- Lost Opportunities – When you’re stressed, you tend to make defensive, short-term decisions instead of proactive, long-term moves. That means missed investments, delayed savings, or avoiding beneficial risks like starting a side business.

- Higher Debt – The survey found that 25% of workers have borrowed from their retirement plan to pay down credit cards. It’s a cycle that delays your future security.

- Health Impact – Chronic stress can lead to high blood pressure, weakened immunity, and burnout. Money stress can become health stress, which becomes even more money stress.

If you’re feeling it now, you’re not alone. But you don’t have to stay here.

The Path to Financial Freedom

Financial freedom isn’t just about having a certain number in the bank — it’s about being in control of your money, instead of your money controlling you.

In TheMoneyBooks series, we call this process The 7 Money Milestones — a clear, step-by-step plan that anyone can follow, no matter where they’re starting from. Let’s walk through them as the antidote to financial stress.

1. Secure Your Financial Education

The first milestone isn’t saving money — it’s understanding money. Without a solid foundation, even a high income can disappear quickly.

- Learn how debt works (and how interest really adds up).

- Understand the difference between assets that grow and expenses that drain.

- Get familiar with financial terms so you can make decisions with confidence.

📌 Action Step: Take the Financial Literacy Quiz to find out where you stand today. It’s only 25 questions, and it’s the fastest way to see your blind spots and start closing them.

2. Protect Your Income & Loved Ones

You can’t build wealth if you’re always one crisis away from losing it. This is where proper insurance — especially life insurance — comes in.

Too many people put off this step, thinking they’ll “get to it later.” But coverage is cheaper when you’re younger and healthier, and it’s the only way to make sure your family’s future isn’t left to chance.

3. Build an Emergency Fund